- Summary:

- The AUD/USD technicals are certainly lining up for a potential downside move, but confirmation will hinge on the Fed's outlook tomorrow.

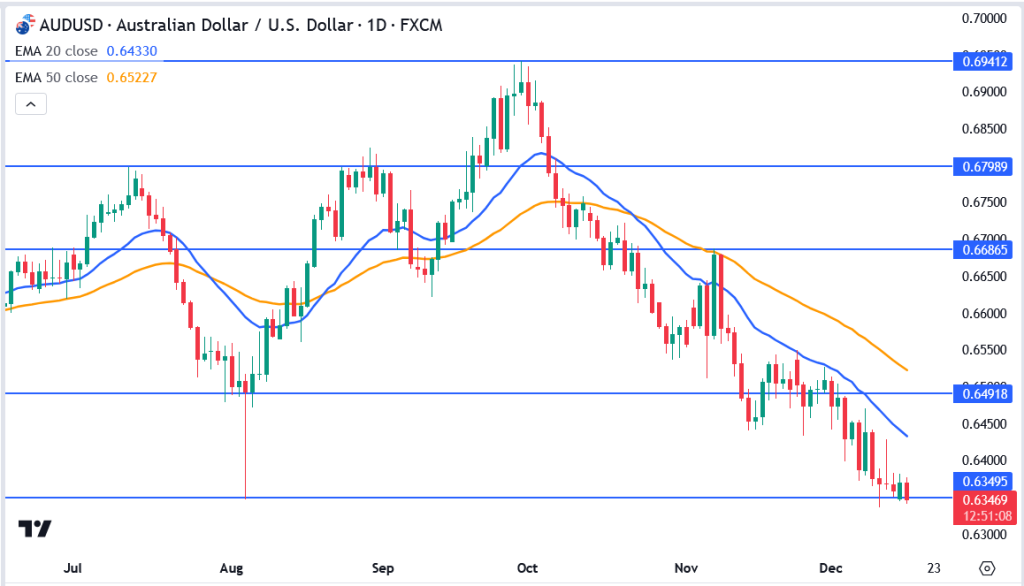

The AUD/USD pair is down 0.4% today, erasing yesterday’s gains and once again testing the August low of 0.6347. We’ve been here before, with last week’s low touching 0.6336, but both the daily and weekly closes managed to hold steady. The key question now is: will it hold again this time, or is a steeper downside break imminent? The pressure is definitely building.

China Weakens Yuan, Adding to AUD/USD Pressure

A major challenge for the Australian dollar is China’s ongoing decision to allow the yuan to devalue. The USD/CNY pair rose to 7.28 today, reaching its highest point in two weeks. This trend adds further pressure on the Aussie, considering Australia’s economic connections to China. At the moment, it’s challenging for AUD/USD to remain above water.

RBA Dovish Shift Weighs on the Aussie

The Australian aspect of the situation isn’t providing much comfort either. The Reserve Bank of Australia (RBA) has begun to embrace a more dovish stance, which is putting pressure on the AUD. The possibility of a rate cut in February has emerged, with markets estimating a 65% likelihood of a 25 basis point decrease.

This shifting stance contrasts with earlier expectations of a longer period of tighter monetary policy. The more dovish outlook is another factor making it harder for AUD/USD to gain any significant ground.

All Eyes on the Fed for the Next Move

For traders, this week will ultimately come down to the U.S. dollar side of the equation. The Federal Reserve decision is the major event to watch, with its outcome likely to settle whether we get a deeper downside break in AUD/USD.

Key Levels to Watch

- Support: 0.6347 (August low), 0.6336 (last week’s low)

- Resistance: 0.6491, 0.6433 (20-day EMA)

The technicals are certainly lining up for a potential downside move, but confirmation will hinge on the Fed’s outlook tomorrow. Traders are waiting for a signal, and if the Fed remains hawkish, AUD/USD could see a sharper break lower.