Ethereum price momentarily broke above the $4,000 mark on Monday before easing down by 0.6% to trade at $3,926 at the time of writing. The $4k mark has emerged as a psychological barrier for ETH price in this crypto rally cycle, and stability above that level could signal a bullish rally.

ETH price has lost 2% of its value in the last week, putting investors at a crossroads on whether to buy the dip or take profit. Below, we assess the implications of either choice, including the inherent risks carried.

ETH Price Bullish Case: Buy the Dip

According to IntoTheBlock, 94% of ETH holders are “In the Money”. Therefore, it wouldn’t hurt them to sell a portion of their assets and use it to buy more ETH at a cheaper price. However, that would have to be based on the assumption that Ethereum price will rise in the coming days.

A look at the ETH long/short ratio shows that more investors have adopted long positions on ETH, with the ratio at 2.85 in the last 24 hours. If the trend continues, we will likely see an ETH price surge, as a long/short ratio reading above one (1) typically signals bullishness.

Meanwhile, IntoTheBlock reports that Ethereum’s total Exchange netflows declined in the last seven days from +$54.14 million to -$190.81 million. That means investors are increasingly moving their ETH from exchanges either to their wallets or staking them. The behaviour signals that they are not in a hurry to trade their coins and could be hopeful of a price resurgence in the coming days.

Bearish Case for ETH Price: Take Profit

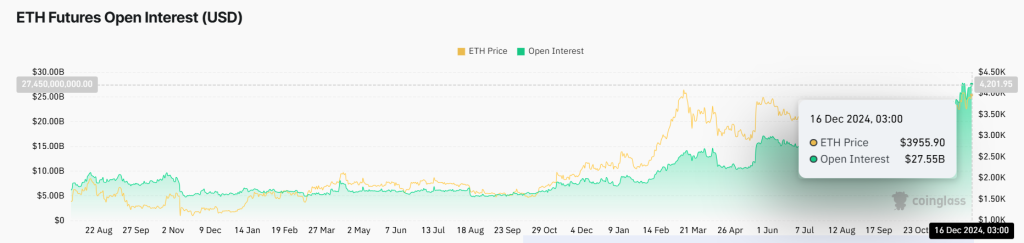

Also, the value of ETH open interest declined significantly in the last 7 days, from $27.70 billion (with the average price at $4,005) to $27.55 billion as of this writing. This signals that investors are less confident of the asset’s future performance than they were a week ago. Therefore, this adds credence to selling one’s ETH holdings.

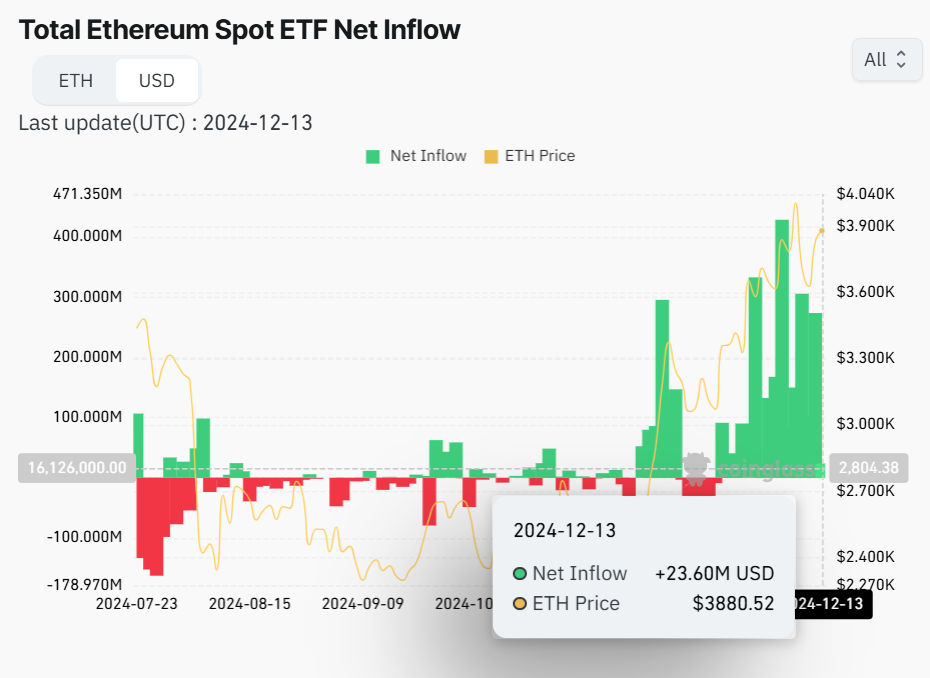

Also, Ethereum’s ETF performance declined substantially in recent days, signifying waning demand. According to Coinglass data, net inflows dropped from $273.70 million on Thursday to $23.60 million on Friday. That could add more downward pressure on Ethereum price if the trend continues.

ETH price prediction

In conclusion, there are valid reasons for going long or short on ETH. However, the ETF performance and exchange inflow/outflow metrics are more reliable barometers of the market tractory. Therefore, I expect ETH price to continue with its consolidation below $4,000 in the near-term.

Pivot: ETH price pivots at $3,930, and the momentum indicator favours the downside.

Support: Immediate support is likely to be at $3,890. A stronger downward momentum could test $3,840.

Resistance: Primary resistance will likely come at $3,960. A breach of that mark will invalidate the downside narrative. That could open the path to test the second resistance at $4,000.