- Summary:

- The Best FTSE 100 Index stocks are those that have outperformed the Index's average return of 14 percent this year.

The FTSE 100 Index has had a relatively good run in 2024, with its year-to-date returns at 14 percent. Therefore, the best FTSE 100 stocks have registered returns above that figure. Below, we look at how three of the best performers, Natwest, Beazley and DS Smith share prices have faired.

DS Smith

DS Smith (LSE: SMDS), the British packaging manufacturing giant, has had a stellar performance this year, with its year-to-date gains at 78.5 percent as of this writing. In addition, the stock has gained 19 percent in the last month. The trend is likely to continue, as American conglomerate, International Paper is in the process of acquiring it.

First announced in April 2024, the £7.8 billion deal follows a familiar script in which major companies listed at the London Stock Exchange have become targets of acquisition by US-based companies due to their perceived undervaluation. Over 99 percent of the International Paper shareholders voted to approve the acquisition in mid-October, and what remains is regulatory approvals. This sets up DS Smith share price for a potential strong upside in the coming days.

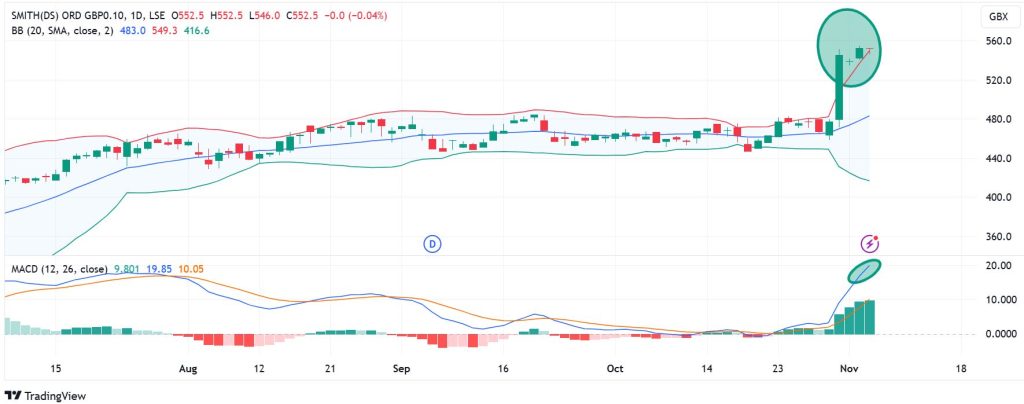

DS Smith share price on a daily chart above MACD indicator and Bollinger Bands. Source: TradingView.com

Beazley

Beazley share price has been among the best FTSE 100 stocks in 2024, thanks to its strong revenue performance. The insurance juggernaut reported forecast-beating earnings in the last two halves, including record half-year profit of $729 million in August. With its footprint in Europe, North America and Asia, the company’s market diversification has enabled it to stay on the growth path in a particularly difficult year underlined with high interest rates across major economies.

Notably, its investment income grew by 75 percent year-over-year to $252 million, which the company attributed to portfolio diversification. Beazley (LSE: BEZ) share price has risen by 47 percent year-to-date. In addition, its 20-EMA (GBX 774.2) is above the 50-EMA (GBX 762.9) level, signifying a bullish undercurrent.

Beazley share price with the 20,50, 100 and 200 EMA on the daily chart. Source: TradingView.com

Natwest

With its year-to-date gains at 75 percent, Natwest share price has outperformed its peers at the LSE, including Barclays, whose YTD gains stand at 58 percent and Lloyds Banking Group, whose YTD gains stand at 14 percent. In addition, Natwest’s price-to-earnings ratio of 7.43 as of this writing, better than the industry median of 11.89. Furthermore, its forward P/E ratio of 8.08 outperforms the industry median of 11.95

At GBX 385.7, the Natwest (LSE: NWG) share price currently trades above the 20,50,100 and 200 Exponential Moving Average (EMA) levels on the daily chart. Also, it is substantially above the Volume Weighted Moving Average (VWMA), which is currently at 364.2. This underlines its strong bullish momentum and signifies substantial upside potential.

Natwest share price above the VWMA on a daily chart. Source: TradingView.com