- Summary:

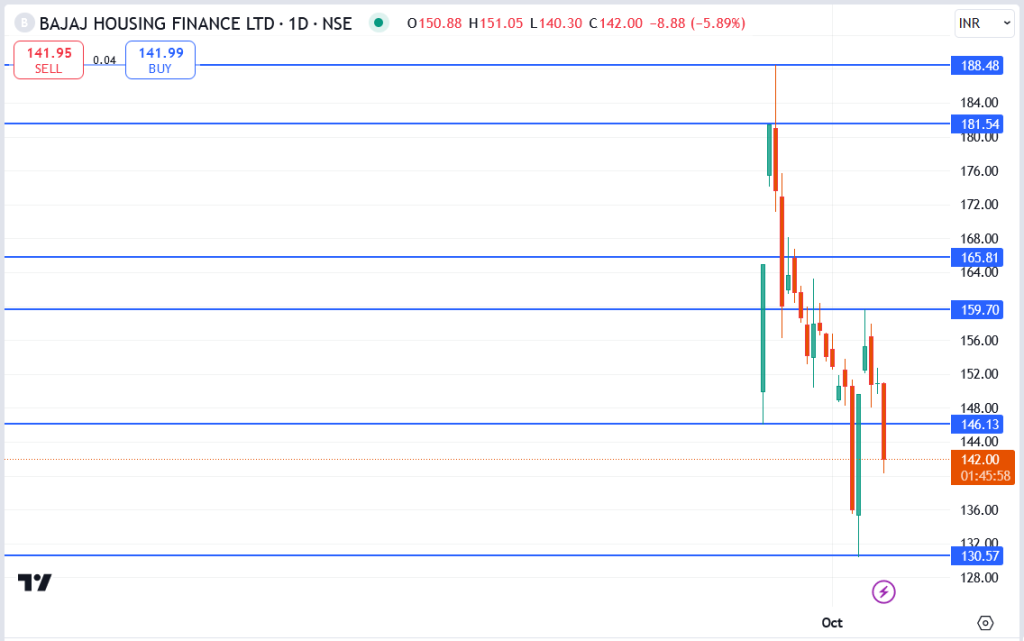

- The Bajaj Housing Finance Ltd (NSE: BAJAJHSG) share price dropped to 142.00 INR, marking a sharp decline of 5.89%.

The Bajaj Housing Finance Ltd (NSE: BAJAJHSG) share price dropped to 142.00 INR, marking a sharp decline of 5.89%. With the stock trading near its support level, traders are eyeing 130.57 INR to see if buyers will step in or if the bearish trend will continue.

Key Support and Resistance Levels

- Immediate Support: 130.57 INR. If the price breaks below this, further declines could follow.

- Key Resistance: 146.13 INR – The first hurdle for any potential recovery.

- Other Important Levels: 159.70 INR A notable target if buyers regain control.

- 165.81 INR A key resistance level that could signal strength if surpassed.

What’s Driving Bajaj Housing Finance’s Current Trend?

Bajaj Housing Finance shares have been weighed down by the cloud of rising interest rates, as investors grow cautious about the sector’s future. While the stock has seen a pullback, Bajaj isn’t standing still.

Outlook for Bajaj Housing Finance Stock

While Bajaj Housing Finance faces the challenge of increasing interest rates, investors are unsure

if better times are on the horizon. With a focus on expansion and careful monitoring of the market, Bajaj is striving to change the situation. Whether this stock bounces back or takes a breather, one thing’s for sure—Bajaj is here to stay, ready to seize any opportunity to regain its momentum. Keep an eye on those key levels, because this story’s far from over!.