- Summary:

- BOME price rose by more than 18 percent on Monday, with crypto investors looking at FOMC interest rate meeting for possible cues.

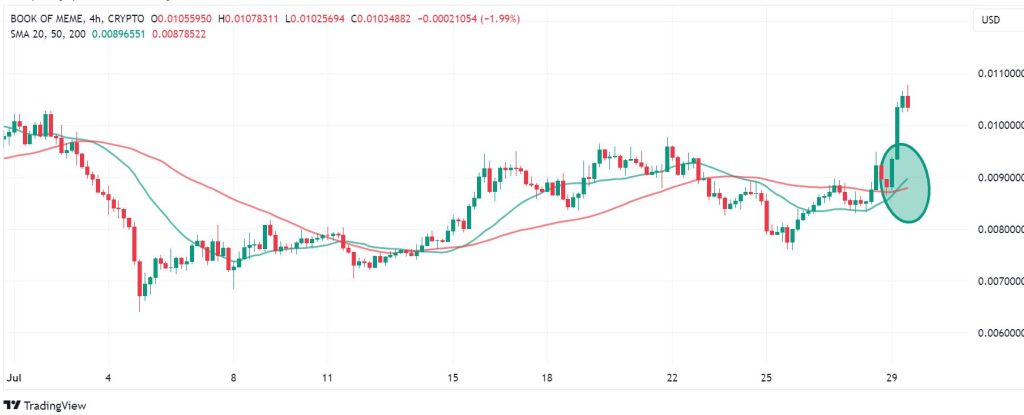

Book of Meme (BOME) Coin price spiked on Monday, rising by 18.1 percent at the time of writing on the daily chart to trade at $0.0104. With that move, BOME has broken out of its downward trajectory that kept it subdued last week, leading to a decline of 7.9 percent on the weekly chart. The crypto market has been flashing signs of a potential breakout to the upside in recent days, and BOME’s move epitomizes the sentiment bubbling under.

Many investors are waiting for cues from FOMC’s meeting on Wednesday, which could have implications on the dollar’s strength. Notably, the Solana ecosystem has experienced rapid growth in the last quarter, with its meme coins like Dogwifhat, and BONK standing out with multiple double-digit growths on the daily chart.

Momentum indicators

On the 4-hour chart below, the momentum on BOME price shows control by the buyers, with three green candlesticks just above the upper band on the Bollinger Bands indicator. In addition, the RSI is at 71, as of this writing, adding to the upside view.

Meanwhile, the 20-period Simple Moving Average (SMA) has just crossed above the 50-SMA, on the 4-hour chart, to strengthen support for the continuation of the upward trajectory.

BOME price support and resistance levels

On the 30-minute chart, BOME looks to have found a pivot at $0.0102. Therefore, the upside will likely continue if the price action stays above that mark. That could see the BOMEUSD pair encounter the first resistance at $0.0105. If the buyers extend their control at that point, they will likely break the resistance and potentially move higher to test $0.0107.

However, the sellers could take control if the pair moves below $0.0102. That could see the establishment of the first support at the $0.0100 psychological mark, but further control by the sellers could breach that support and invalidate the upside narrative. Also, it could result in a stronger downward momentum to take the price to $0.0096.