- Summary:

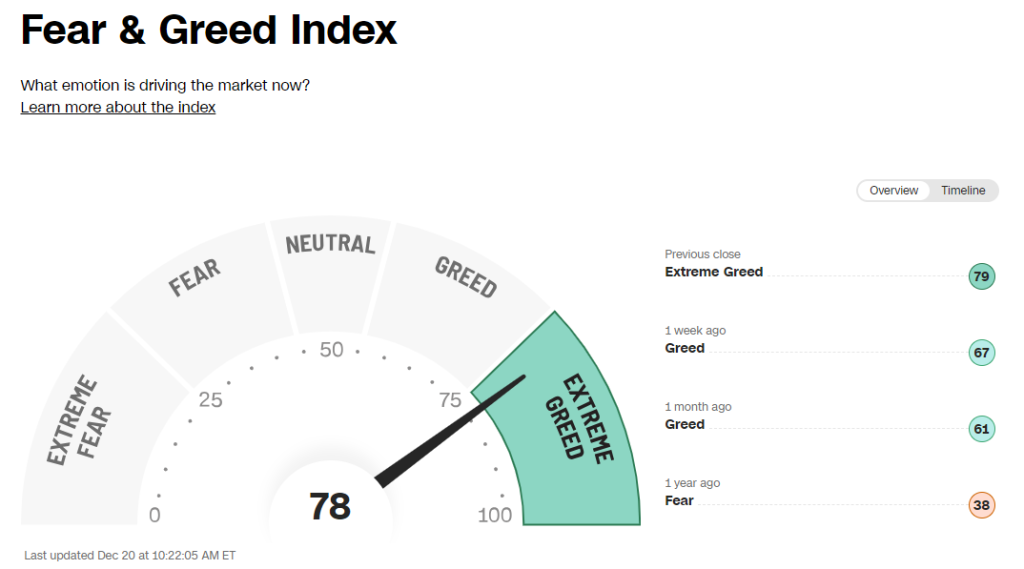

- Fear and Greed Index: The US stocks are hitting overbought levels as the markets signal extreme greed. Will the momentum sustain?

The CNN fear and greed index has hit the levels of extreme greed as the US stock markets continue their ascent. The benchmark indices has surged to record highs as analysts expect the continuation of the dovish policies of US Federal Reserve.

The rally in the US equities caught fire when the Fed didn’t hike interest rates for the third consecutive time in its December FOMC meeting. As a result, the markets are now pricing in the rate cuts to begin as soon as Q1 2024.

According to the analysts at Bank of America, the interest rates in the US may start to decline in March 2024. In addition to this outlook, the bank also changed its rate cuts frequency to 4 from the previously maintained stance of 3.

Consequently, out of the 7 indicators of the fear and greed index, 4 are currently signalling extreme greed in the markets while 1 indicator is showing greed. This suggests that the markets are reaching overbought levels and there are chances of a pullback.

In just a week, fear and greed index has moved to ‘extreme greed’ from ‘greed’. This is an indicator that the investors are taking more risk and the markets are becoming greedy.