- Summary:

- GSK Share Price Forecast: LON: GSK is at a very critical level. The future price action depends on the stock's ability to break above £14.88.

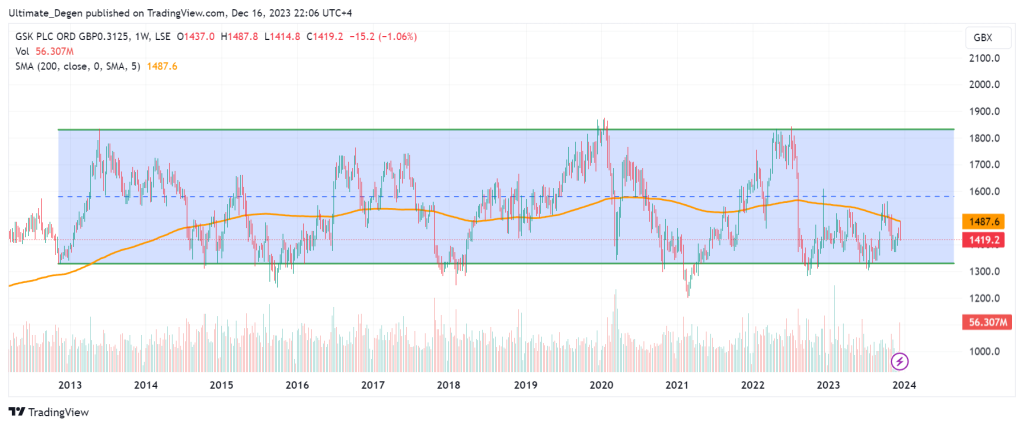

GSK share price wiped off its weekly gains in the last two sessions of the week after a rejection from the £14.88 level. This rejection occurred due to a failed breakout attempt above the 200-weekly moving average. This is a long-term moving average which shows the overall market sentiment around a stock.

After reversing from their weekly high of £14.88, GSK shares had their biggest losing day of the week on Friday. The shares plummeted 2.91% and closed at £14.19 which was their lowest level since 30 November.

The future price action depends on the bulls’ ability to hold the 200-daily MA, which is currently acting as a support. This moving average lies at £14.22 and needs to be held to avoid another retest of the lows of a long-term trading range which lies around £13.32.

After a 1.06% drop this week, GSK stock has underperformed the FTSE 100 index which rose 0.29% during the same time. The stock also underperformed compared to the monthly gains of the Medical sector which remained at 7.01%.

All eyes are now on the upcoming release of the financial results, where the company is expected to report EPS of $0.79, a 23.44% increase on a YoY basis.

GSK Share Price Forecast

The following chart shows the technical analysis of the LON: GSK weekly chart. Such a high timeframe analysis removes the fakeouts and noise to reveal a bigger picture. For the past 11 years, the stock has been trading within the £13.3-£18.34 trading range without any significant breakout.

Nevertheless, the GSK share price forecast may flip bullish if the stock breaks above the 200-weekly moving average. However, in the event of acceptance below £14.22, a retest of the range lows will be on the cards. For this purpose, the next few weeks will be very critical.