- Summary:

- The stock market Fear and Greed Index currently stands at 61 which signals 'greed' in the markets. Its constituent indicators still has more room to grow.

The fear and greed index is signaling ‘Greed’ once again after a fearful March 2023. The strong rebound in the benchmark indices like S&P 500 index and Nasdaq 100 index have contributed most to the sentimental shift. The calm in global banking concerns and the assurances by US & European governments have also played a key role in this regard.

The stock market fear and greed index is based on seven different indicators that track different aspects of the market. These indicators include the momentum tracker, price strength, price breadth, junk bond demand, market volatility, put & call options, and safe haven demand.

S&P 500 Trades Above 125-day MA

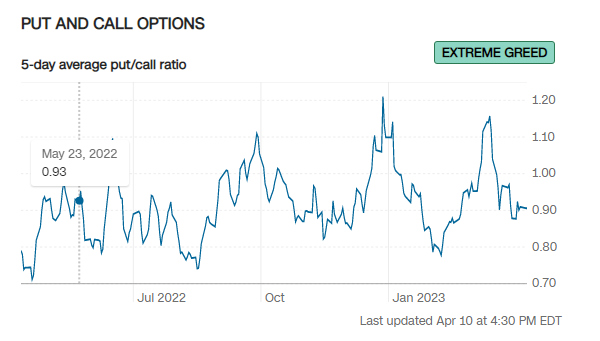

The benchmark S&P 500 index is one of the major indicators of US equities. The index tracks the top 500 publicly listed companies in the biggest global economy. The chart shows that the index is currently trading above its 125-day moving average, which is a sign of increasing momentum. Another important indicator that plays a key role in the Fear and Greed Index is the 5-day put/call ratio.

Data shows that the put/call ratio has been decreasing for the past few weeks. This shows that most investors are bullish on the stock market. The market volatility (VIX) index that tracks market volatility remains neutral at 18.97 and is currently below its 50-day MA.

Fear And Greed Index Still Has Room To Grow

The fear and greed index shifts to ‘extreme greed’ when it goes above 75. Since the index is currently at only 61, the markets still have room to grow. Out of the seven indicators that constitute the top market sentiment index, the put/call ratio and safe haven demand has already hit their ‘extreme greed’ levels.

However, four indicators are neutral, and the Junk Bond Demand is still in ‘extreme fear’. The neutral outlook on most indicators suggests that there could be more upside in the coming days. The volatility may increase this week due to the upcoming release of the March 2023 CPI report.

You are welcome to join my free Telegram group for my updated analysis of the markets.