- Summary:

- Lloyds share price has struggled in the past few years as concerns about a post-Brexit Britain continue. The stock has crashed by almost 40%

Table of Contents

- What is a Lloyds Bank?

- Lloyds share price history

- Lloyds Financial To Stay Strong In Near-Term

- Lloyds Share Price Today

- Lloyds Bank Share News

- Lloyd Bank Reports Week Financials

- Why is Lloyds share price too low?

- When Will Lloyds share price recover?

- Lloyds share price forecast 2023

- Lloyds share price forecast 2025

- Lloyds Bank Share Price Forecast 2030

Lloyds (LON: LLOY) share price has had a mixed start to the year along with other major global banks. In the United States, banks like Bank of America, Citigroup, and Goldman Sachs stocks have been in a downward trend as concerns about their finances persist. They published weak financial results.

After an 18% price rally in the first few weeks of 2023, Lloyds share price is currently trading below its yearly opening. This translates into an almost 15% price decrease from the YTD high. It is also worth mentioning here that Lloyds is not the only bank showing such volatile price action. Shares of other major British banks like HSBC, Natwest Group and Barclays are also showing a similar price action.

Please note that this article was written in September 2022. We regularly update it to incorporate the latest information and developments.

What is a Lloyds Bank?

Lloyds Bank was founded in 1765 in Birmingham. Since then, it has become a leading British company that serves more than 27 million people in the country. Lloyds has a vast network of branches across England and Wales. The bank’s subsidiary, Halifax, serves its customers in Northern Ireland, while the Scottish are served by the Bank of Scotland. Lloyd Banking Group plc is the parent of all these entities.

Lloyds Bank is considered one of the big four clearing banks in the UK. The bank’s 320-year-old history makes it one of the most credible banking institutions in the UK. Lloyds Banking Group plc currently has more than 65,000 employees. Nevertheless, due to less demand for physical branches, the bank will be shutting down some of its branches in the UK over the next few months.

Lloyds Banking Group companies offer different solutions. For example, Embark offers retirement solutions to more than 350k people with over 37 billion pounds in assets. Schroders Personal Wealth is its joint venture with Schroders, a company with over 650 billion worth of assets. Black Horse and LEX Autolease provide auto leasing solutions.

Still, Lloyds Bank makes most of its money from its banking services in the UK. Unlike its peers like Barclays and HSBC, it does not have any major footprint abroad. Following is the monthly chart of LON: LLOY listed on the London Stock Exchange.

Lloyds share price history

Lloyds Bank Group has had a long and challenging period as a publicly traded company in the UK. The firm went public in 1998. At the time, the stock was trading 130p. Shortly afterward, the stock surged to an all-time high of 548p during the dot com boom. The good times ended when the dot com bubble burst, and the shares plunged by 72% between 1999 and 2002.

During the global financial crisis of 2008, Lloyds share price took a massive hit. In fact, Lloyds Banking Group was on the verge of bankruptcy but got bailed out by the UK government. The bank received a bailout package of £20.3 billion. Nevertheless, LON: LOY hit its all-time low value of $16.38 in 2009.

Since then, Lloyd shares have been showing a sideways price action. In 2015, Lloyd stock reached the 89p level. However, the price retraced immediately and has been in a downtrend since then. The price retested a 2014 low of 23p in 2020 and got a strong rebound. The 23p region has become strong support as the price has got multiple bounces from this level.

UK banks were thriving in the high interest rates until the failure of multiple regional banks in the US sounded the alarms across the Atlantic. Consequently, investor faith in the banking industry has hit a new low as the banks report a significant decline in deposits during Q1 2023.

Lloyds Financial To Stay Strong In Near-Term

Lloyds has almost doubled its profits since the rates started to increase. In 2023, the bank’s profit is expected to remain strong. However, in the longer term, the current high-profit numbers might not be sustainable. This is bound to change as the interest rate start coming down next year.

More recently, Lloyds Banking Group plc has released the full results for 2022. The results show an increase of £2.6 billion in underwriting profit. However, due to events like the Ukraine war and Hurricane Ian, the bank had to bear an investment loss of £3.1 billion. This resulted in a pre-tax loss of £800 million.

Another factor contributing to the ongoing downtrend in Lloyds share price is the troubles at Credit Suisse. The Swiss lender is in the news once again amid rumors of getting denied funding from its top investor Saudi National Bank (SNB). Although SNB cited restrictions for its inability to increase its stake in Credit Suisse, the media report suggested otherwise. This led to a massive sell-off in Lloyds (LON: LLOY) share price as the price dropped below 46p in March.

Lloyds Share Price Today

The European Central Bank (ECB) and the US Federal Reserve have both hiked the interest rates with another 25 bps in May 2023. The bank shares are showing a mixed reaction to the news. At one end, high interest rates increase the operating profits of the banks, and at the other end, they also increase the unrealized losses on their balance sheets.

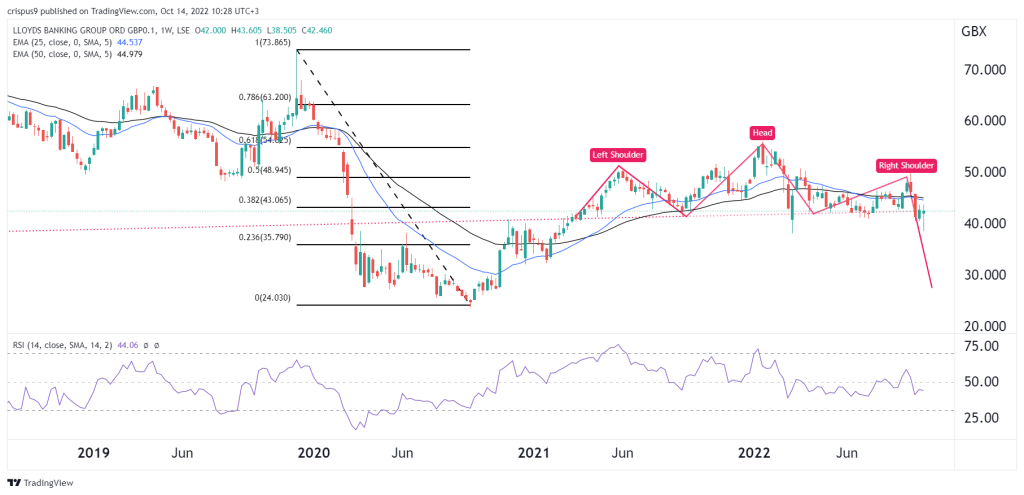

The following LON: LLOY chart shows that the bank’s stock was having a very good rally until the failure of multiple banks in the US. Since then, the shares have dropped to their new yearly lows. The most concerning things for the bulls are the formation of the head & shoulders pattern and the breakdown below 200 MA. Lloyds share price forecast will become extremely bearish if price gains acceptance below 44.6p support. In such a scenario, I expect the shares to drop to their 38.5p support.

Lloyds Bank Share News

Lloyds Banking Group PLC has recently made a big investment in a company developing cutting-edge identity technology. The £10 million investment in Yoti will enable the bank to further secure the personal data of its clients.

According to recent news, Lloyd Banking Group is closing 40 more branches across the country as the demand for physical banking sites has significantly decreased. The move is also being seen as a cost-cutting initiative in the banking sector. Despite the closure of branches, there won’t be any associated job cuts.

In other news, the bank has issued a warning to its clients after a large number of its users recently fell for romance scams. On average, these customers lost around 8,000 pounds.

Lloyd Bank Reports Week Financials

Lloyds Bank reacted to the most recent quarterly results. The company published weak financial results. Its profit after tax dropped to £4 billion as it increased its provisions for bad debt. Its net interest income rose by 15% as the Bank of England continued hiking its interest rates. Its operating costs rose by 6% to £6.4 billion, while its underlying profit before impairment rose by 26% to £5.5 billion.

The other important catalyst for Lloyds share price was the final central bank decision by the Bank of England (BoE). As was widely expected, the bank decided to hike interest rates by 0.50% in its fight against inflation. It also hinted that it would continue hiking interest rates in the coming months. Still, analysts expect that the path for more rate hikes is still limited.

Why is Lloyds share price too low?

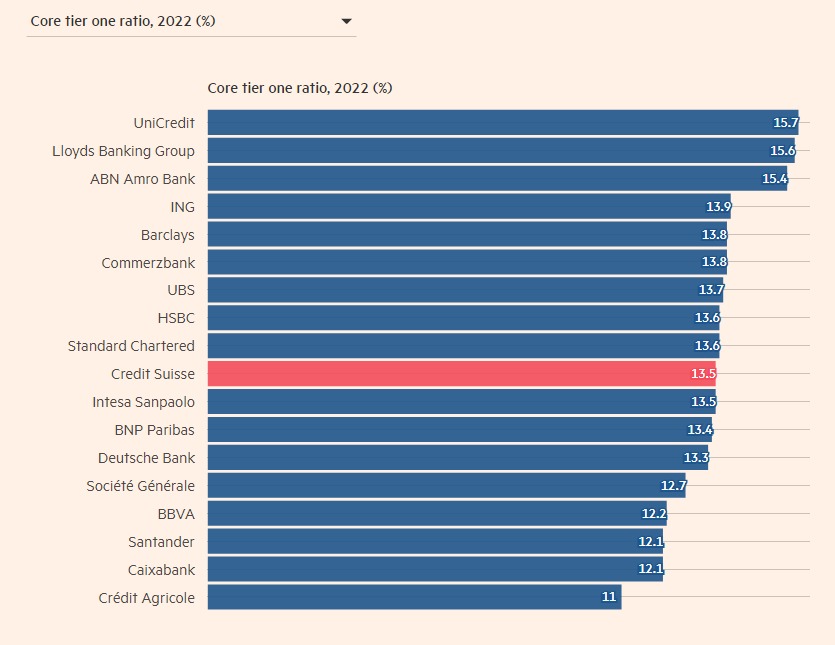

Lloyds share price is undoubtedly cheap. For one, it has a price-to-book ratio of 0.6, making it cheaper than other popular European banks like Intesa Sanpaolo, HSBC, ING, BBVA, and Caixabank. This is also notable since Lloyds has one of the best balance sheets in Europe. As shown below, it has the best core tier-one ratio in Europe after Unicredit.

Lloyds share price is cheap because of worries about the UK economy post-Brexit, the falling British pound, and the overall lack of growth in the banking sector. Also, the low-interest rates of the past decade made it relatively hard to invest in.

When Will Lloyds share price recover?

A closer look at the bank’s stock chart shows that it has struggled to move above the important resistance level at 60p. Therefore, a common question is when the stock will bounce back. It is hard to tell since there are lingering concerns about the UK economy. Also, with global stocks in an overall downward trend, there is a likelihood that it will remain in a consolidation phase for a while. Nevertheless, considering the current uptrend, a reclaim of the 2022 high of 56 GBX is quite likely in 2023.

Lloyds share price forecast 2023

Since the start of this year, Lloyds share price has failed to gain strength above the key psychological level of 50p despite multiple retests. The following LON: LLOY chart also shows that the price has broken below the upwards trendline on its daily chart. Currently, the price is being supported by the 200-day moving average, which lies at $46.28.

An acceptance below 200 MA on the daily chart will be very bearish for Lloyds shares as the next support will be the October low which lies at 38.6p. This will be a more than 21% drop from the current share price.

Lloyds share price forecast 2025

The next few years will be difficult for Lloyds and other UK banks like NatWest and Virgin Money. That’s because analysts believe that the UK economy will struggle in the coming years. A look at the weekly chart shows that the stock formed what looks like a head and shoulders pattern. In price action analysis, this pattern is usually a bearish sign.

The stock is also below the 38.2% Fibonacci Retracement level and the lower side of the Andrews Pitchfork. Therefore, there is a likelihood that the stock will fall below 30p by 2025.

Lloyds Bank Share Price Forecast 2030

To be fair, it is relatively difficult to predict where the stock will be in 2030. But looking at the monthly chart below, we see that it has been in a bearish trend in the past two decades. In this period, it moved below the descending trendline shown in black. In this period, it has crashed below all moving averages. Therefore, we can’t rule out a situation where the shares crash to about 25p by 2030.