- Summary:

- In today’s trading session, Tonic price is up by 5 per cent, continuing a strong bullish trend that has persisted for the past 2 sessions

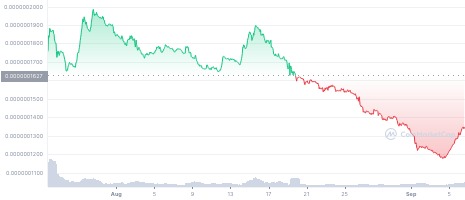

In today’s trading session, Tonic price is up by 5 per cent, continuing a strong bullish trend that has persisted for the past two trading sessions. However, despite the past few trading sessions’ growth in the markets, Tonic’s price has struggled throughout the year.

After it was launched in December last year, the crypto prices quickly surged and hit an all-time price high of $0.0000040 by December 23, 2021. However, the prices would start taking a nose-dive immediately, and by the time we were getting into 2022, Tonic had already entered a strong and aggressive bearish trend.

Today, its value stands at 96 per cent below its all-time high. In recent months, the trend of the crypto has also looked aggressively bearish, and there is a high likelihood that the current push to the upside is a price retracement.

Tectonic (Tonic) is a cross-chain money market that allows users to deposit their cryptocurrency assets, lend them to other users, and earn interest. The lenders in the platform are referred to as liquidity suppliers.

The platform targets three types of users; those who want to deposit their digital assets and hold them for an extended amount of time to make interest, short-term borrowers and users who want to capitalize on different cryptocurrencies without becoming liquidity providers.

Tonic Price Prediction

The platform has also had its high this year. For instance, in early April, the platform was able to hit its all-time high total value locked in the platform, $566 million. However, liquidity providers on the platform started pulling their assets, and by June, the total value locked had dropped to below $200 million.

Although the platform has continued to struggle in the markets, the past few months have seen many liquidity providers coming back into the platform. Today, the total value locked stands at $228 million, and there is a high likelihood that we might see an improvement in the coming months.

However, despite my positive outlook on Tonic’s liquidity providers, I expect the crypto to continue suffering in the markets. The current price surge is temporary, and there is a high likelihood that we might see prices continuing to fall and trading below the $0.000000120 price level.

Tonic Chart