- Summary:

- In the past few weeks, controversies such as the plummeting virtual land prices have seen Sandbox prices continue to fall in the markets.

In the past few weeks, controversies such as the plummeting virtual land prices have seen Sandbox prices continue to fall in the markets. In today’s trading session, the negative news cycle we have seen in the past few weeks is still strong, with prices falling by a percentage point and extending the streak of two consecutive sessions where Sandbox has closed with a price loss.

A week ago, I reported that data was showing that the virtual land in the Sandbox platform had been in downfall for 9 months. According to the data, the land prices had fallen to trade at a quarter of their value when the year started. Today, the same situation has continued to impact the Sandbox platform.

There is also another factor that has played a significant role in the current price drop of Sandbox, the crypto industry’s current bear market. The current Sandbox price drop has been in tandem with the general trend of the cryptocurrency industry. Part of the reason for this is due to the positive correlation that the altcoin has on major cryptocurrencies, which means that, when they are performing dismally, Sandbox prices are also dragged down.

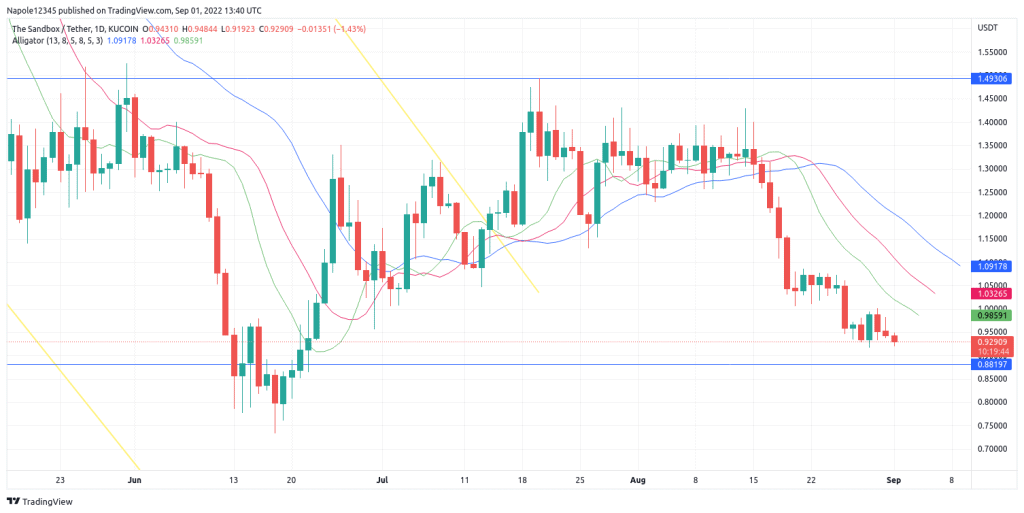

Sandbox Price Analysis

Coming into September, I expect the current strong and aggressive bearish trend to continue. Part of the reason for my Sandbox’s bearish trend analysis is due to the current fall in the price of the platform’s digital assets, such as land. The current bear market of the cryptocurrency market has also contributed greatly to my analysis, which has seen prices continuing to fall for the past few weeks.

Therefore, there is a high likelihood that we may see Sandbox hitting the $0.88 support level. My analysis also expects that, in the next few trading sessions, the prices will have fallen to trade as far down as below the $0.80 price level. My strong bearish trend analysis will only be invalidated by prices trading above $1.

Sandbox Daily Chart