- Summary:

- Apple stock price has pulled back sharply in the past few days as the company’s recent recovery fades. What next for the AAPL shares?

Apple stock price has pulled back sharply in the past few days as the company’s recent recovery fades. The AAPL shares have dropped to $157, which is lower than August’s high of $176. This price is about 22% from the lowest point in July.

Strong US dollar is a concern

Apple share price has been in a downward trend in the past few days as the company faces multiple issues. First, the company is facing the challenge of its exposure to Taiwan and China. The firm relies heavily on Taiwan for its key parts like chips. It also has a lot of exposure to China, where its products are manufactured,

There have been substantial risks to this exposure. For one, the possibility of a Chinese invasion of Taiwan has raised following the recent visit by Nancy Pelosi. At the same time, a drought in China has led to a major drying of Yangtze and other rivers. The impact is that many companies have been forced to lower production.

Another risk that Apple is facing is the strong US dollar index (DXY). The greenback has surged to its highest level in over 20 years. With wage growth slowing, it means that the company will likely struggle this year. For example, an iPhone costing $1,000 in January was selling at 113,000 yen in Japan in January this year. Today, the same phone would go for 139,000 yen. Sadly, the same situation is happening around the world.

Apple stock price forecast

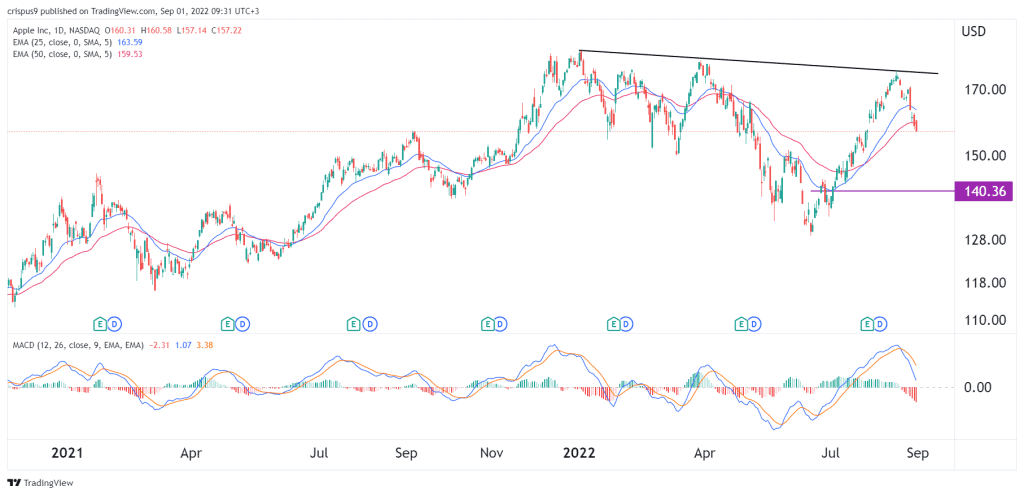

The daily chart shows that the AAPL stock price has dropped sharply in the past few days. A closer look shows that the stock has formed a triple-top pattern that is shown in black. The shares have moved below the 25-day and 50-day moving averages while the MACD has made a bearish crossover.

Historically, a triple-top is usually a bearish sign. Therefore, there is a likelihood that the shares will likely continue falling as sellers target the key support level at $140. A move above the resistance at $165 will invalidate the bearish view.