- Summary:

- The GBP/JPY exchange rate moved sideways on Thursday morning as investors focused on the state of the British and Japanese economies

The GBP/JPY exchange rate moved sideways on Thursday morning as investors focused on the state of the British and Japanese economies. It was trading at 161.66, which was slightly above this week’s low of 160.91. This price was about 4.30% below the highest point in 2022.

BOE and BoJ divergence

The GBP to JPY exchange rate moved sideways as investors focused on the divergence between the Bank of Japan and the Bank of England. The BoJ has insisted that it will maintain a dovish tone for a while as it seeks to support the economy. Data published this week show that the low interest rates are working. For example, on Wednesday, data showed that retail sales rose modestly in July.

On Thursday, data showed that the Japanese manufacturing PMI rose from 51.0 in July to 51.5 in August of this year. A PMI reading of 50 and above is a sign of expansion. The Bank of England, on the other hand, has maintained a hawkish tone in its bid to fight the soaring inflation.

It has hiked rates in all its meetings since December. Analysts expect that the UK economy is staring at a deep recession in the coming months. For example, inflation is expected to surge to over 13% in October and peak at about 20% in 2023. The next key catalyst for the GBP/JPY exchange rate will be the coming UK house price index (HPI) index. Analysts expect that UK home prices remained at the contraction level of 46.

GBP/JPY forecast

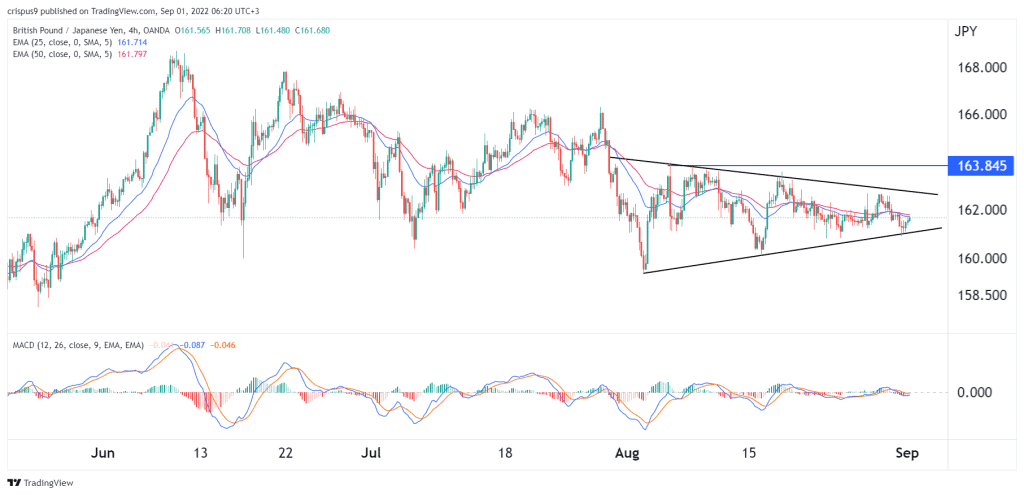

The four-hour chart shows that the GBP/JPY price has been in a tight range in the past few days. As a result, it is consolidating at the 25-day and 50-day moving averages. The pair has also formed a symmetrical triangle pattern that is shown in black while the MACD has moved slightly below the neutral point.

Therefore, with the triangle nearing its confluence level, there is a likelihood that it will have a breakout in September. A bearish breakdown will see the pair move below the important support at 160 while a bullish one will see it rise to 163.