- Summary:

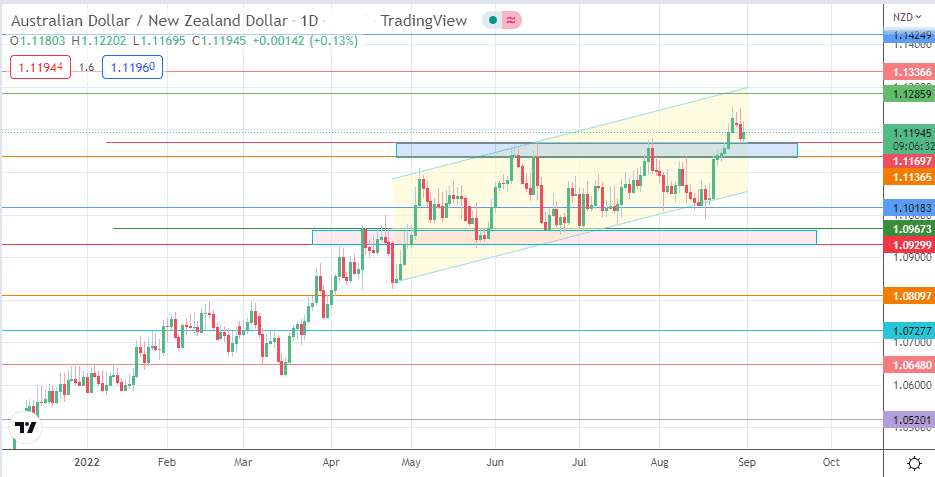

- A bounce on the 1.11697 support level is required to maintain the uptrend on the AUD/NZD ahead of next week's crunch economic data.

After lacklustre manufacturing PMI data from China, the AUD/NZD pair has surrendered some of its earlier gains of the day. The pair remains marginally higher but has so far been unable to push itself significantly above the recent lows that cluster around a former supply zone that now forms a solid support level.

Data from China shows that manufacturing and non-manufacturing PMI data did not differ significantly from expectations, allowing the pair to respond primarily to technical plays due to a lack of clear direction. The markets would now have to look forward to next week’s key data

for clearer direction. On Tuesday, 6 September, the Reserve Bank of Australia would reveal its interest rate, accompanied by a statement from Governor Philip Lowe. Westpac is calling for a 50bps move in this meeting.

Technically speaking, the 25 August violation of the former supply zone has turned this zone into a firm support. Furthermore, the rejection of corrective price action on 30 August and maintenance of this zone as support provides an impetus for the bulls to maintain the uptrend, pending the release of stronger market-moving data.

AUD/NZD Forecast

The bounce on the former supply zone that acted as a previous resistance sets the tone for an uptrend continuation. The bulls need to clear the highs of 26-29 August to attain the 1.12859 resistance (25 October 2017 high). Above this level, there are resistance targets at 1.13366 (26 March 2017 high) and 1.14249 (24 August 2015 high). These are only attainable if the bulls achieve a clearance of the 1.12859 resistance.

On the flip side, there has to be a breakdown of the former supply zone’s borders at 1.11697 and 1.11365 to open the door for a correction. This corrective decline would initially target 1.10183, where the previous lows of 2 August and 16 August 2022 are located. A breach of this pivot opens the door toward the 1.09673 support, which is the upper edge of the previous demand zone with 1.09299 as the price floor. If this zone gives way under bearish momentum, the bears would have a clear path toward 1.08097 (4 April low). There is another pivot below this level at 1.07277, where the 26 January and 11 March highs form role-reversed support levels.

AUD/NZD: Daily Chart