- Summary:

- The USD/JPY forecast ahead of the preliminary US GDP report and the speech of the FOMC Chair Jerome Powell is presented.

The USD/JPY is one of the currency pairs that will attract significant market attention on Thursday and Friday as the 2022 edition of the Jackson Hole symposium opens. This event features several FOMC board members, from Fed Chair Jerome Powell to various regional Fed Presidents, who are expected to present speeches.

The USD/JPY continues to inch towards its recent highs seen in July, which refreshed highs last seen in 1998 during the Japanese banking crisis. The greenback holds close to 20-year highs ahead of this event, as the markets await Friday’s speech by the Fed Chair for indications of how aggressive or conservative the Fed may be on any further adjustments to monetary policy in response to inflation.

Despite the cooling of consumer and producer prices in the last report, recent Fedspeak, especially from a noted hawk and St. Louis Fed President James Bullard, suggests that the September meeting will feature another 75 bps rate hike. Whether or not the Fed Chair will double down on this outlook will be seen on Friday.

Thursday’s preliminary GDP report could be a pointer to whether recessionary risks could temper Fed action exist. Traders of Fed Funds futures are pricing in a 61% probability of another 75 bps rate hike and a 39% chance of a 50 bps upward adjustment in September. The USD/JPY is trading 0.29% lower in early Thursday London trading.

USD/JPY Forecast

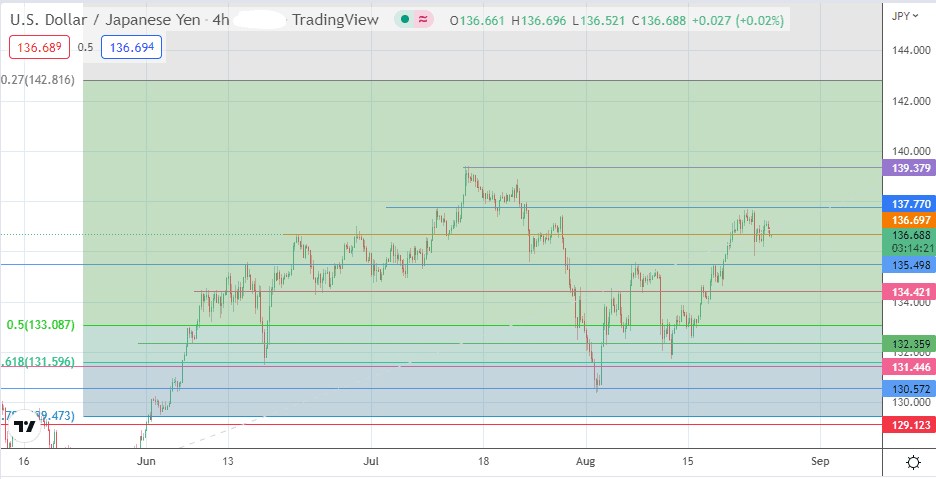

The correction seen on the chart has met support at the 136.697 price mark. A decline below this support level brings 135.498 into the mix as the next target, the location of the previous highs of 8/17 August 2022. Additional downside targets lie at 134.421 (9 June and 3 August highs) and the 50% Fibonacci retracement level at 133.087.

However, a bounce on the 136.697 support enables the pair to aim for a breach of the resistance at 137.770 (11 July and 22 August peaks). A break of this resistance opens the door for a retest of the 14 July high at 139.379. If the bulls take out this resistance barrier, they will have clear skies to aim for new record highs. Potential targets at this time would be the 140.00 psychological price mark and also the 142.816 price mark formed by the 27% Fibonacci extension.

USD/JPY: 4-hour Chart