- Summary:

- The Aviva share price target has been given a 9.8% premium by nineteen institutional investors, even as the correction continues.

The Aviva share price is sharply lower this Thursday as the bears continue to extend the correction following the recent surge seen on 10 August. On that date, Aviva Plc announced its earnings results showing a 14% increase in its H1 2022 profits.

The 892 million pounds profit exceeded the company’s forecasts of 742 million pounds, as commercial lines and a boost in its private clients’ business shored up the company’s earnings. The Aviva share price also got a boost on that day after it announced a share buyback program and declared an interim dividend of 10.3p, in tandem with its full-year expected payout of 31.0p.

Following this result, the Aviva share price shot up more than 12%. However, the corrective move has taken off slightly less than 40% of the gains it has notched since the 14 July low Citi and Credit Suisse both lifted their share price targets for Aviva. While Citi expects the Aviva share price to hit 441p, Credit Suisse has lifted its Aviva share price outlook from 455p to 480p.

Citi expects the size of the shares buyback program to hit 300 million pounds. Nineteen institutional analysts have provided a consensus price target of 481p, which gives the stock the potential for a 9.8% upside in the near term.

Aviva Share Price Forecast

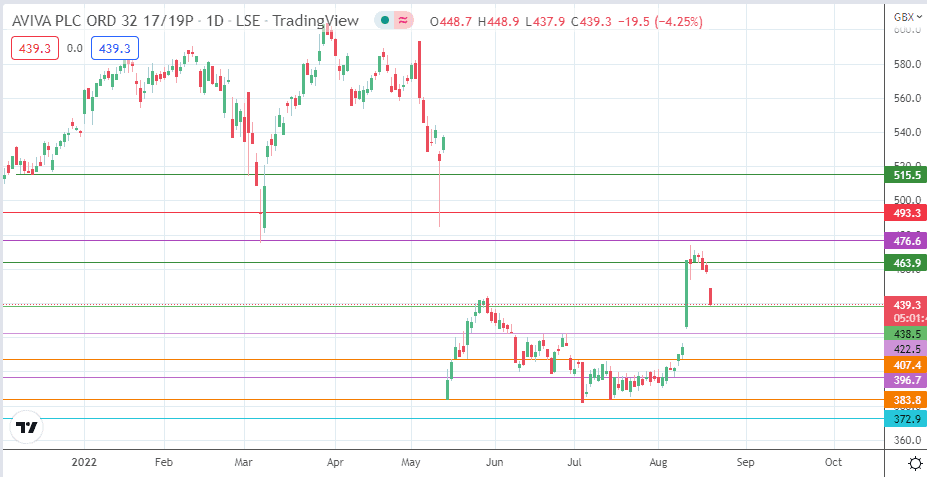

The corrective decline is now testing the support at 438.5. A breakdown of this pivot extends the correction toward the 422.5 support (9 June low and 28/29 June highs). Only a break of this price mark will make 407.4 (17 June and 9 August lows) and 396.7 (23 June and 5 August lows) additional valid southbound targets.

On the other hand, the bulls will have to force a bounce on the current pivot and break the resistance barriers at 463.9 (17 August high) and 476.6 (11 August high) for the uptrend recovery move to continue. If this occurs, the 493.3 resistance becomes the primary target, followed by 13 December 2021/2 March 2022 lows at 515.5.

Aviva: Daily Chart