- Summary:

- IAG share price rose to the highest point since July 29 as aviation stocks recovered. The shares have rallied by about 20%

IAG share price rose to the highest point since July 29 as aviation stocks recovered. The shares have rallied by about 20% from the lowest level this year, meaning that they are close to a bull market. It is trading at 122p, giving the British Airways parent company a market cap of over 6.12 billion pounds. Other aviation stocks like EasyJet, Ryanair, and Wizz Air have also rallied.

IAG is the parent company of several companies like British Airways, Iberia, Aer Lingus, Vueling, and Level. It is one of the biggest airlines in Europe. The stock has rallied in the past few weeks as investors focus on the rebound of the aviation sector. Demand for both regional and intercontinental travel has risen in the past few months.

At the same time, there are signs that jet fuel will continue dropping in the next few months. Besides, the price of crude oil has moved from the year-to-date high of $135 to about $90 per barrel. Therefore, IAG will benefit since jet fuel is its biggest costs. At the same time, the company will likely maintain its higher ticket prices for a while.

IAG share price rose after the company decided to convert a debt to Air Europa into a stake. The company will now become a 20% of Globalia, the parent company of Air Europa. This happened after IAG provided a 100 million euro loan to the company in March this year.

IAG share price forecast

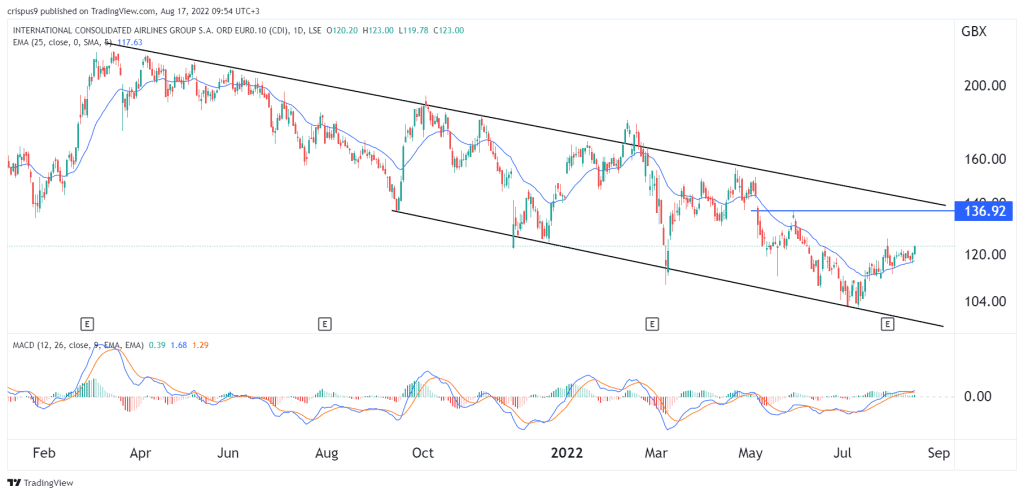

The daily chart shows that the IAG stock price has been in a strong bullish comeback in the past few weeks. Along the way, the stock moved to the middle part of the descending channel that is shown in black. It has also moved slightly above the 25-day moving average while the MACD has been in an upward trend.

Therefore, the shares will likely continue rising as bulls target the next key resistance point at 136p, which was the highest point on May 30. A drop below the support at 115p will invalidate the bullish view.