- Summary:

- The USD/CNY price surged to the highest level since May this year as concerns about the Chinese economy continued.

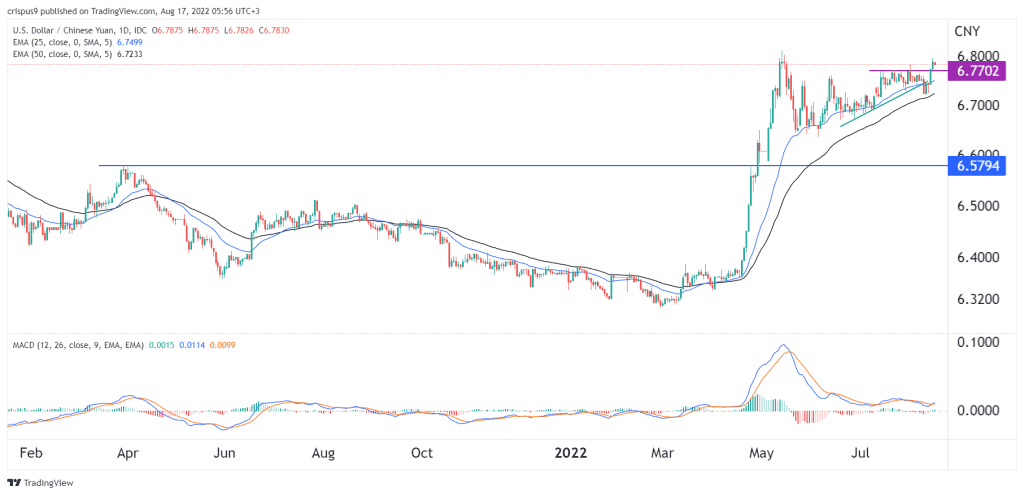

The USD/CNY price surged to the highest level since May this year as concerns about the Chinese economy continued. The pair rose to a high of 6.80, which as the highest point since May 16th of this year. It has jumped by more than 7% from the lowest point this year.

Chinese economy and FOMC minutes

The USD to yuan exchange rate continued its bullish trend as investors focused on the performance of the Chinese economy. Data published earlier this week showed that the country’s industrial production and retail sales grew at a slower rate than expected. As a result, China’s central bank decided to slash two interest rates in a bid to stimulate growth.

At the same time, China’s authority took more measures to save the embattled property market. Recently, the property market has struggled as liquidity in the sector has eased. Many people have also stopped paying mortgage for their incomplete projects.

The next key catalyst that will move the USD/CNY price will be the upcoming US retail sales data and FOMC minutes. Economists expect the data to show that the country’s retail sales dropped sharply in July as the cost of goods and services rose. The minutes will provide more color about the deliberations that happened in July’s Federal Open Market Committee (FOMC) meeting.

USD/CNY forecast

The four-hour chart shows that the USD to CNY price has been in a strong bullish trend in the past few weeks. On Wednesday, it managed to move above the important resistance level at 6.770. It also rose above the 25-day and 50-day moving averages while the MACD has done a bearish divergence.

Therefore, the pair will likely keep rising as bulls target the next key resistance level at 6.90. A drop below the support level at 6.75 will invalidate the bullish view.