- Summary:

- The AUD/USD price retreated to the lowest level since August 10th after the latest RBA minutes. What next for the AUD to USD exchange rate?

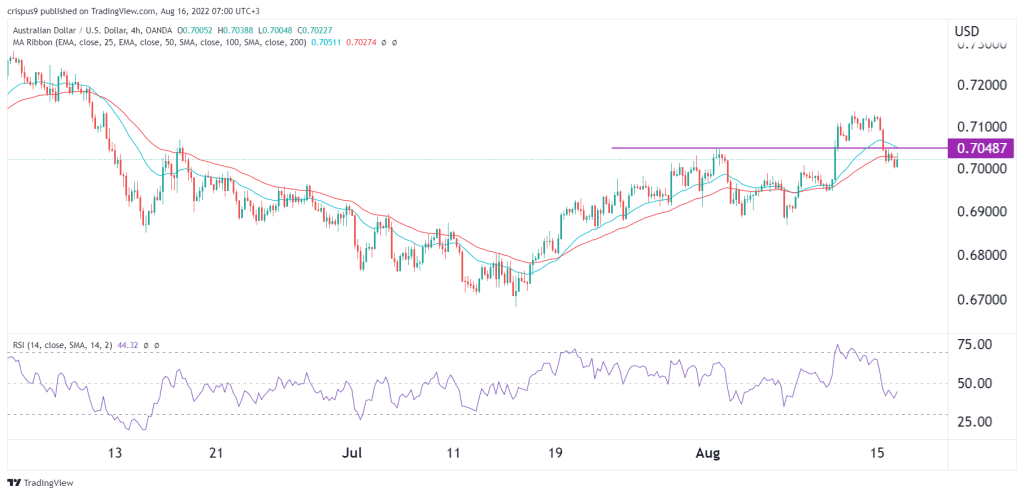

The AUD/USD price retreated to the lowest level since August 10th after the latest RBA minutes. The AUD to USD exchange rate was trading at 0.7023 on Tuesday morning, which was about 1.57% below the highest point this month.

RBA minutes and commodity prices

The Australian dollar declined sharply as concerns about the health of the Chinese economy continued. Data published on Monday showed that the country’s industrial production, retail sales, and fixed asset investments grew at a slower pace in July. As a result, the country’s central bank decided to intervene by slashing two important interest rates.

The AUD/USD price also declined because of the falling commodity prices. The closely-watched Bloomberg Commodity Index (BCom) declined to the lowest level in months. Key commodities that Australia sells like iron ore and copper have pulled back because of the challenges facing the Chinese economy.

The RBA published minutes of the past monetary policy meeting. The minutes showed that officials expect that inflation will peak this year and then drop to the 2% range in the coming year. They also warned about the impact of high-interest rates on the property sector.

The next key catalyst for the AUD/USD price will be the upcoming US housing starts and building permit numbers. They will then be followed by the upcoming Fed minutes and US retail sales data.

AUD/USD forecast

The AUD to USD price pulled back to a low of 0.7021 as concerns about the Chinese economy continued. It moved slightly below the important support level at 0.7050, which was the highest point on August 1. The pair dropped below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved below the neutral level.

Therefore, the AUD/USD price will likely continue falling as sellers target the next key support at 0.6900. A move above the resistance at 0.7050 will invalidate the bearish view.