- Summary:

- In today’s trading session, Centrica's share price is up by a percentage point, continuing a trend that started on Friday last week.

In today’s trading session, Centrica’s share price is up by a percentage point, continuing a trend that started on Friday last week. However, despite today’s gains, Centrica is still down by 8 percent for the month, almost wiping out all the gains made in July, when the company rose by 9.6 percent.

The recent Centrica share price struggle in the markets comes amidst one of its largest deals in recent years. This month, it was announced that the company had signed a 7 billion pound ($8.47 billion) agreement with US-based Delfin Midstream Inc that will see the company buying liquefied natural gas (LNG) from 2026, according to reports.

The reports also said Britain’s largest energy supplier had entered the 15-year deal with the aim of buying 1 million tonnes of LNG per annum on a free on board (FOB) from the Louisiana-based company from 2026. The current deal with the US-based company will see Centrica become more prepared for future political uncertainty.

Today, following sanctions on Russia and the UK has continued to struggle to keep its energy costs lower due to its dependence on Russian oil. In October, the energy price cap is expected to up, which will see the annual average bill reach £3,582. However, the rising cost is likely to see Centrica profits continue to improve a month after the company restored its dividends following a record-breaking profit year that was partly fueled by soaring energy prices.

Centrica Share Price

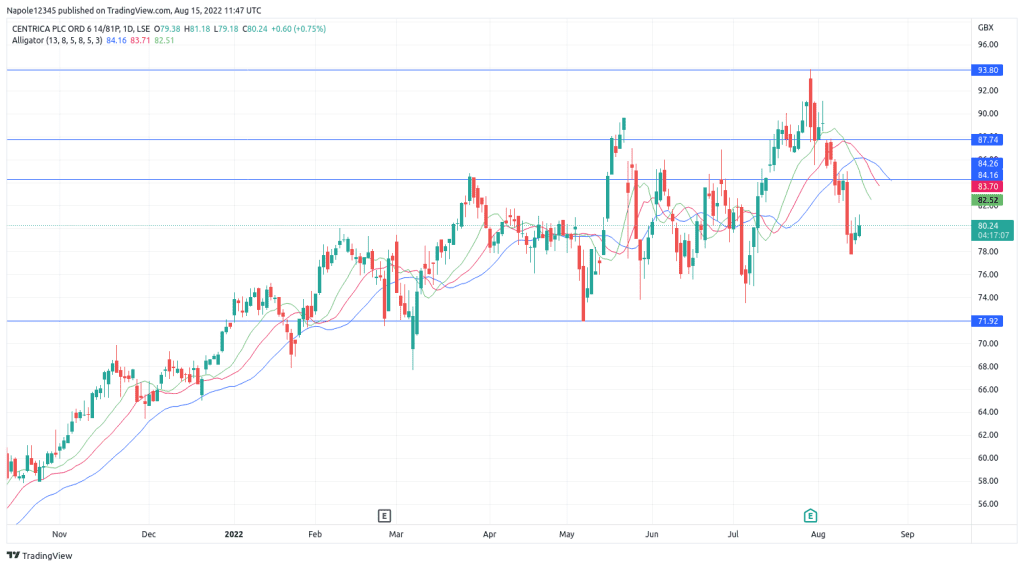

The chart below shows a strong push to the upside in the past two trading sessions, with today’s Centrica share price soaring by a percentage point. However, the chart also shows that, since July 28th, the share prices have been in a strong bear market that has resulted in a drop of 17 percent.

Therefore, the recent price gains may likely be a retracement rather than a price reversal. Based on the chart, Centrica is still in a strong bear market. There is a high likelihood that, despite showing strong and aggressive bearish moves in the past two trading sessions.

The prices will continue with the trend and hit the 71 demand level. It is also highly likely that the prices will fall below the 70p price level in the coming trading sessions. My analysis will be invalidated should the prices trade above the 84p price level. At that point, the bullish trend will be clear.

Centrica Daily Chart