- Summary:

- As the CAC 40 index enters into a period of consolidation in the last week following the upside push, some are asking if the rally is over.

The CAC 40 index is only marginally higher this Friday after gaining nearly 0.85% in the last two trading days. Despite being on course to end the week higher, the CAC 40 index’s latest slump in trading volumes may indicate that the uptrend is now facing exhaustion.

Capping gains this Friday was underwhelming data from France. A drop in the monthly consumer price inflation data from 0.8% in June to 0.3% in July (consensus of 0.3%) was not followed by a corresponding drop in the annualized number. French CPI year-on-year rose from 5.8% to 6.1%, providing a conflict with the monthly number. HICP also fell from 0.9% to 0.3%.

The conflicting status of the inflation numbers did not allow market participants in the CAC 40 index to push the market in any direction. As a result, the 0.08% upside push is considered highly marginal for a market that size.

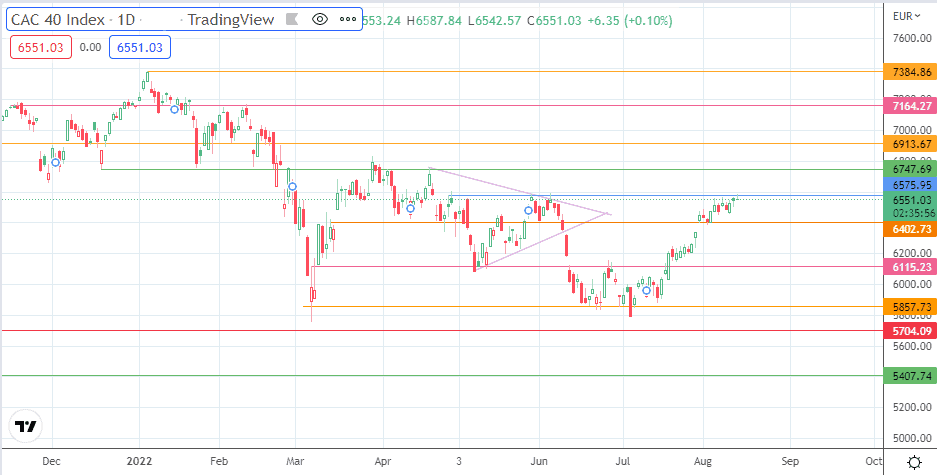

From the standpoint of technical analysis, the price is trading in a range that is bordered by the 6575 price mark (ceiling) and the 6402 support level, acting as the floor. Therefore, future price direction on the CAC 40 index is a function of the direction via which the price activity will breach the range.

CAC 40 Index Forecast

The 6575 resistance mark is the barrier to beat for the bulls. A break of this price mark targets 6747 (21 April high), leaving 6913 (4 February low and 23 February high) and the 14 January/10 February highs at 7164 as the other targets to the north. The 5 January 2022 high at 7384 remains a valid target but is presently far off.

On the other hand, rejection at the current resistance allows the bears to set off a correction. This corrective decline would target 6402 initially (4 May and 3 August highs) before 6200 enters the mix as psychological price support. If the correction continues, the 6115 (12 May low and 13 June high) price support becomes a new downside target, leaving 5857 (20 June and 6 July high) and 5704 (26 February 2021 low) as additional targets to the south if the decline is more extensive.

CAC 40 Index: Daily Chart