- Summary:

- The GBP/AUD pair could extend the downside break of the rectangle, targeting 2017 lows if the UK GDP data ends up being dismal.

The GBP/AUD is on the second day of a downward move, falling 0.37% after Rabobank reiterated its bearish perception of the British Pound to back up last week’s gloomy outlook by the Bank of England. Rabobank believes the Pound would collapse under the current economic headwinds to sink below the 1.2 mark on the GBP/USD pair.

The report by the UK government signifying the potential of blackouts this winter as energy prices rise above 4,000 pounds per household further puts the Pound on the back foot against its peers. The negative outlook is already pressurizing the GBP/AUD pair. However, recent gains in commodity prices and China’s apparent containment of the latest round of its COVID-19 Omicron outbreak are giving the Aussie Dollar some tailwinds of late.

The GBP/AUD pair had been in a downtrend since the 22 February trendline break, going on an unprecedented 10-day slump before entering the range that formed the rectangle pattern. The last fundamental trigger for the week comes from the UK GDP data. The polled economists predict a hefty contraction of the UK economy. If this plays out according to expectations, we could see the GBP/AUD extending the downtrend in the short and medium term.

GBP/AUD Forecast

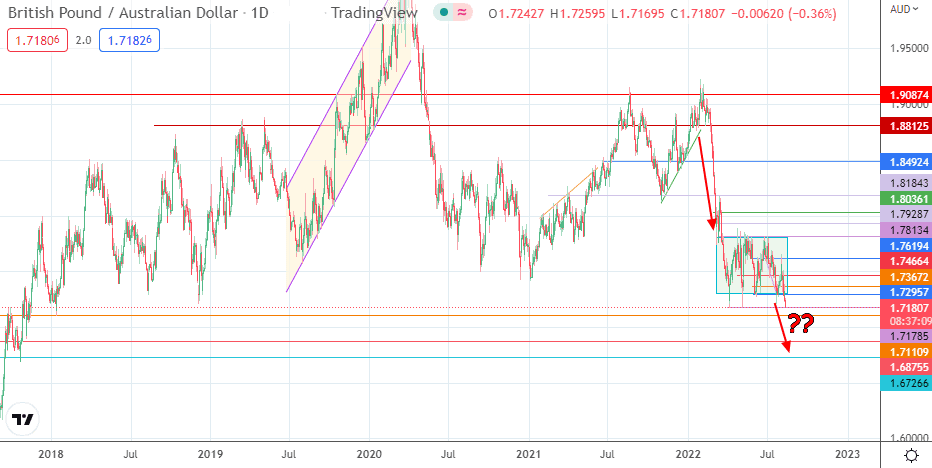

The breakdown of the long-standing rectangle pattern conforms to the expected standards of technical analysis as the initial trend preceding the rectangle was a downtrend. However, the markets can now expect a pursuit of the support that completes the measured move. This lies at the multi-year lows of 11 August 2016 and 19 October 2017, formed at 1.67266.

The 1.68755 support level formed by the previous lows of 26 September 2016 and 29 June 2017 form an intervening barrier at 1.68755. However, the 5 April and 5 May lows at 1.71785 form the immediate support target, whose violation opens the door to another target at 1.71109 before the multi-year lows come into the picture.

Any recovery would depend on the bulls successfully defending the 1.71785 support. A bounce from this point would serve up 1.72957 (rectangle’s lower border) as the immediate upside target. If there is no rejection of the return move, 1.73672 (1 August low) and 1.74664 (8 August high) become additional upside targets.

GBP/AUD: Daily Chart