- Summary:

- A positive trade balance and higher commodity imports could boost activity on the Shanghai index this Monday.

The Shanghai index closed Friday’s trading session 1.34% higher but still closed marginally lower for the week. However, the Shanghai index could start the week on a positive note if traders respond positively to the news of a surge in China’s commodity imports for July 2022.

Data from China’s Customs authorities show that China’s July copper imports rose 9.3% year-on-year after a slump in price triggered renewed buying appetite. The renewed demand also comes as domestic copper inventories in China fall. However, the 463,693.8 tonnes worth of copper imports represented a 13.8% slump from the June figures.

Similarly, coal imports rose to their highest 2022 levels as power companies acquired more of the product to keep up with the summer surge in demand for electricity in the country. As a result, the 23.52 million tonnes imported into China last month was 25% higher than June’s imports but paled when compared to last year’s imports for the same period under review.

The data point to the possibility of improved industrial production. A positive trade balance seen in July could also boost the sentiment of the index when it opens for the new week.

Shanghai Index Forecast

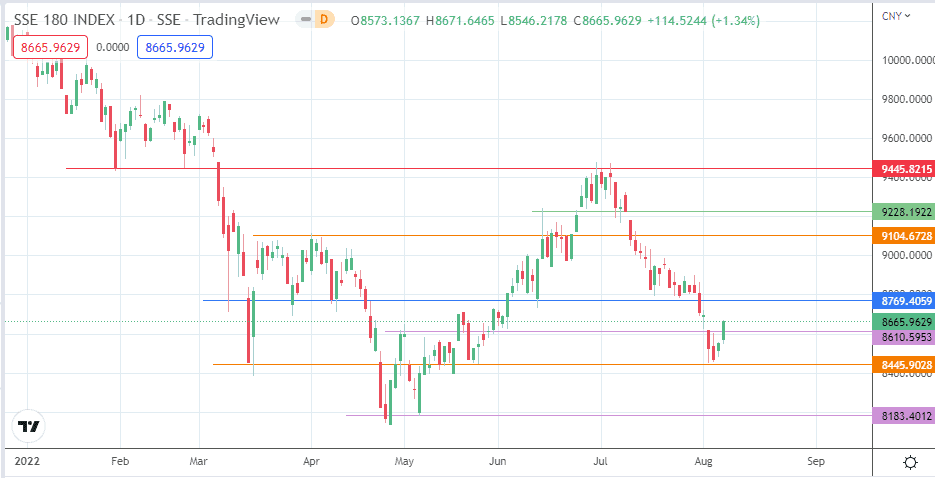

The violation of the 8610 resistance clears the pathway for the bulls to target the 8769 resistance target, formed by the previous high of 21 April and just below the previous lows of 18/25 July.

A clearance above this level puts 9000 in bullish crosshairs, being the site of a prior low of 12 July 2022. Above this psychological price mark, the 9104 resistance (1 April and 23 June highs) and 9228 (15/24 June highs) are additional price targets to the north. Only if the bulls clear these targets can 9445 (28 January and 24 February low) become a viable target to the upside.

The advance is truncated if the bears can degrade the support at 8610 and the 2 August low at 8445. This move will make downside targets at the 8400 psychological price mark (19 May 2022 low) and the 8183 support formed by the 10 May low become available.

Shanghai Index (SSE 180): Daily Chart