- Summary:

- Boeing stock price has staged a strong recovery in the past few weeks as investors cheer the company's performance.

Boeing stock price has staged a strong recovery in the past few weeks as investors cheer the company’s performance. The stock rose to $167, which was the highest level since April 27th. It has risen by about 50% below the lowest level this year, bringing its total market cap to almost $100 billion.

Boeing has received a series of positive numbers in the past few months. First, the firm is set to benefit from a strong rebound in defense spending due to the ongoing war in Ukraine. This is notable since Boeing is one of the biggest defense contractors in the world, with a backlog of over $55 billion.

Second, the company recently cleared a key hurdle for resuming 787 Dreamliner deliveries. This means that the company will continue delivering the model. It has about 120 undelivered Dreamliners worth about $25 billion.

Third, the company recently reported strong cash flows than expected. Further, the company increased its 737 production rate to 31 per month and captured about 169 737 max orders. In the recent Farnborough Air Show, the company secured over 200 orders, bringing the total backlog to about 4,200 planes worth over $297 billion.

Most importantly, the Boeing stock price has risen sharply because of the ongoing recovery of of the civil aviation industry. Recent results by airlines showed that the companies were seeing strong recovery as more countries reopen.

Boeing stock price forecast

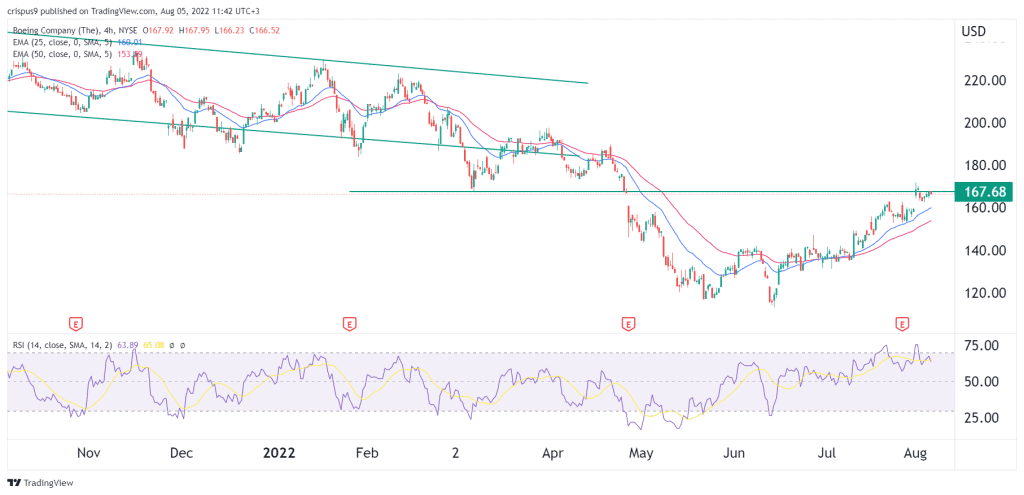

Turning to the four-hour chart, the Boeing stock price has made a strong bullish trend in the past few days. The shares moved above the important resistance at $140, which was the highest level on June 8th. The current level is an important level since it was the lowest level on March 8th of this year.

The stock has risen above the 25-day and 50-day moving averages (MA) while the Relative Strength Index (RSI) has moved slightly below the overbought level. Therefore, the stock will likely continue rising as bulls target the next key resistance at $200. A drop below the support at $160 will invalidate the bullish view.