- Summary:

- The GBP/AUD price went parabolic after the latest interest rate decision by the Reserve Bank of Australia. What next ahead of BoE?

The GBP/AUD price went parabolic after the latest interest rate decision by the Reserve Bank of Australia (RBA). It surged to a high of 1.7651, which was the highest point since July 12th of this year. At its peak, the pair was about 2.57% above the lowest level in July.

BoE interest rate decision next

The GBP to AUD price jumped after the latest interest rate decision by the RBA. The RBA, as expected, decided to hike interest rates by 0.50%. Its fourth interest rate hike brought the total hikes this year to 150 basis points. This is the most hawkish RBA has been in more than two decades.

The Australian dollar retreated against most currencies after the rate decision. This retreat happened since the rate hike was in line with what analysts were expecting. As a result, market participants sold the fact since the decision was in line with expectations. Analysts believe that the bank will continue hiking interest rates.

The GBP/AUD retreated slightly after mixed Australia retail sales data on Wednesday. Sales rose from 1.0% to 1.4% in the second quarter even as inflation remained at an elevated level.

The next key catalyst for the pair will be the upcoming interest rate decision by the Bank of England (BoE). Analysts believe that the bank will continue with its hawkish policies in this meeting. Precisely, they expect that the bank will increase interest rates by 0.50%, the biggest increase in more than a decade.

Recent data showed that UK’s inflation surged to a multi-decade high of 9.4%, the highest increase in more than three decades. It also has the highest inflation rate in the G7.

GBP/AUD forecast

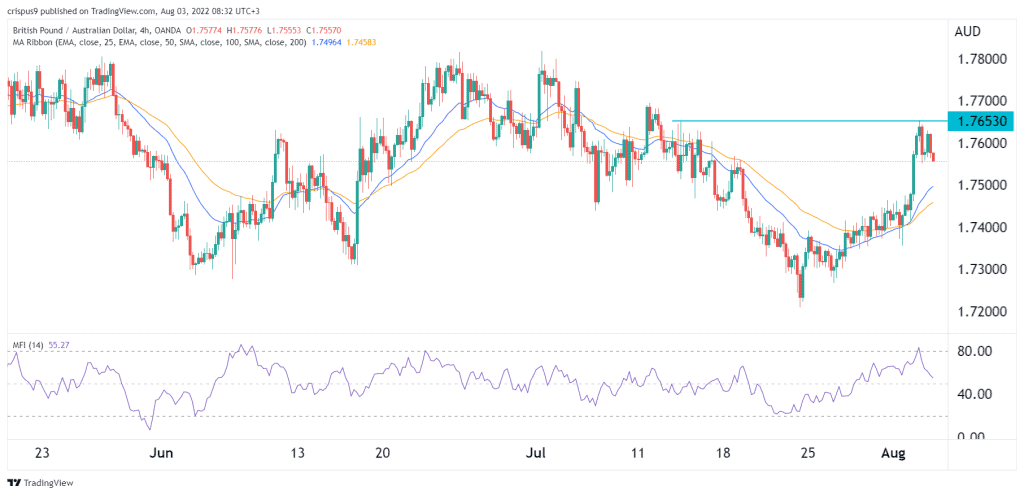

The four-hour chart shows that the GBP to AUD exchange rate has been in a strong bullish trend in the past few days. The pair rose to a high of 1.7653, which was the highest point since July. While this recovery has faded, it remains above the 25-day and 50-day moving averages, while the Money Flow Index (MFI) has tilted lower.

Therefore, the pair will likely continue falling as traders wait for the upcoming BoE decision. If this happens, the next reference level will be at 1.7500. A move above the resistance at 1.7653 will invalidate the bearish view.