- Summary:

- Reliance Industries share price soared to ₹2,606, which was the highest level since June 30th of this year. What next for the shares?

Reliance Industries share price soared to ₹2,606, which was the highest level since June 30th of this year. The stock has risen by more than 8.8% above the lowest level in July. On the other hand, the shares have dropped by about 10% from their highest level in April this year. The recent recovery is in line with the Sensex and Nifty 50 indices.

Jio spectrum win

Reliance Industries is a leading Indian company with a stake in critical sectors in the Indian economy. It is one of the country’s biggest oil refiners and is a leading player in the telecommunication and retail sectors. As a result, the company has benefited from the rising demand for oil and gas in India and other Asian countries.

The Reliance Industries share price is rising after the company’s Jio brand spent $11 billion for India’s airwaves. India sold spectrum worth over $19 billion across multiple bands like 5G. In its purchase, Jio bought 24,740 megahertz of airwaves.

Other companies that participated in the auction were Bharti Airtel, Adani Data Networks, and Vodafone Idea. As a result, the stock rose as investors cheered hopes that the firm would dominate the 5G space.

The auction happened a week after Reliance Industries published earnings. The company’s earnings increased by 46% to over $2.3 billion. Its refining revenue rose to over ₹2.23 trillion, a 55% increase. At the same time, its total costs surged by 51% to ₹1.98 trillion. Jio has a net income of ₹43.35 billion.

Reliance Industries share price forecast.

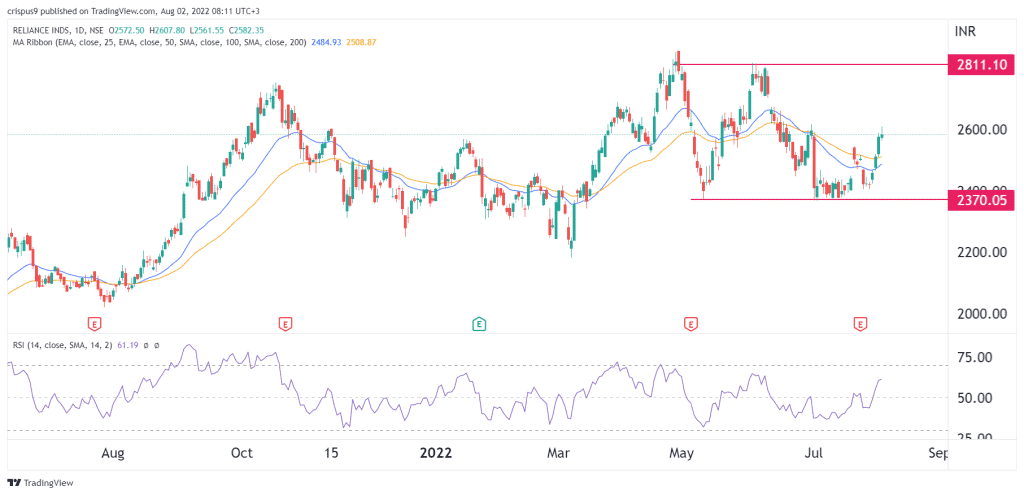

The daily chart shows that the RII share price has sharply recovered in the past few days. This rebound happened after the stock found strong support at 2,370. It struggled to move below that level several times this year.

The shares have moved above the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has moved above the neutral level. Therefore, the shares will likely continue rising as investors target the upper side of the channel at 2,811. A drop below the support at 2,500 will invalidate the bullish view.