- Summary:

- The EUR/GBP price remained under intense pressure on Tuesday morning ahead of the upcoming BOE interest rate hike.

The EUR/GBP price remained under intense pressure on Tuesday morning. Investors shifted their focus to the upcoming interest rate decision by the Bank of England (BOE) and the weak manufacturing data from the UK and EU. As a result, the euro to pound exchange rate dropped to a low of 0.8378, about 3.91% below the highest level in June this year.

BOE decision next

The EUR/GBP price has been in a major sell-off in the past few days as investors reflect on the upcoming decision by the BoE. Analysts expect that the bank will deliver its biggest interest rate hike since 1994 in a bid to calm the soaring inflation. Data published in July showed that UK’s inflation jumped to 9.4%, the highest point in the G7 and the highest increase in more than three decades.

The BOE has already hiked interest rates five times since December. But unlike the Fed and other major banks, it has focused on the standard increase of 0.25%. Still, this hike will come at a time when the UK economy is facing numerous challenges. For example, data published on Monday showed that manufacturing activity dropped to the worst period since 2020.

The EUR/GBP price also dropped as concerns about the European bond market waned. The closely watched Italian bond yields retreated as the political situation improved slightly. As a result, the spread between German and Italian bonds dropped to the lowest level since May this year. Analysts were expecting another EU debt crisis after the latest ECB decision.

EUR/GBP forecast

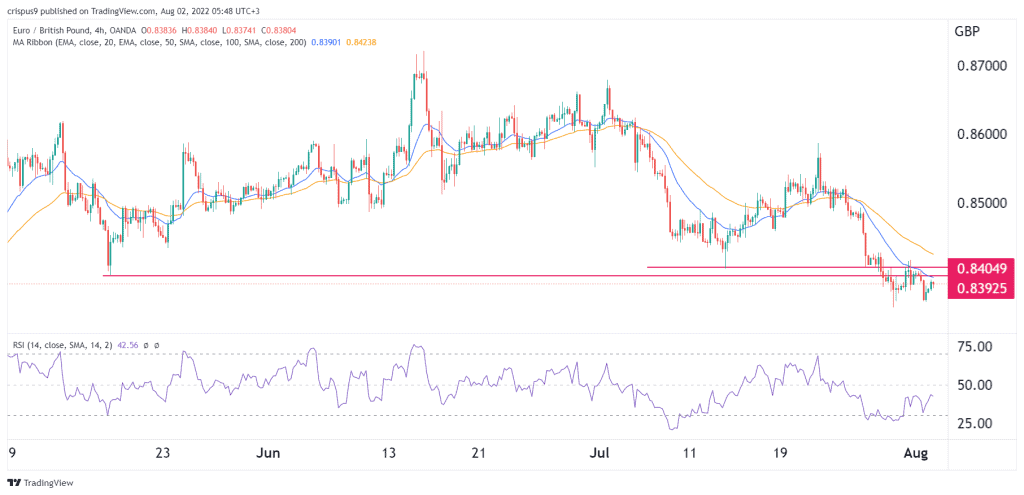

The four-hour chart shows that the EUR to GBP exchange rate has been in a strong bearish trend in the past few weeks. The pair has dropped below the 25-day and 50-day moving averages. It has also managed to move slightly below the important support levels at 0.8405 and 0.8392.

The Relative Strength Index (RSI) has moved slightly above the oversold level. Therefore, the EUR/GBP price will likely continue falling as sellers target the next key support level at 0.8340. A move above the resistance at 0.8400 will invalidate the bearish view.