- Summary:

- The USD/CHF price dipped to the lowest level since July 4th as investors reflected on the interest rate decision by the Federal Reserve.

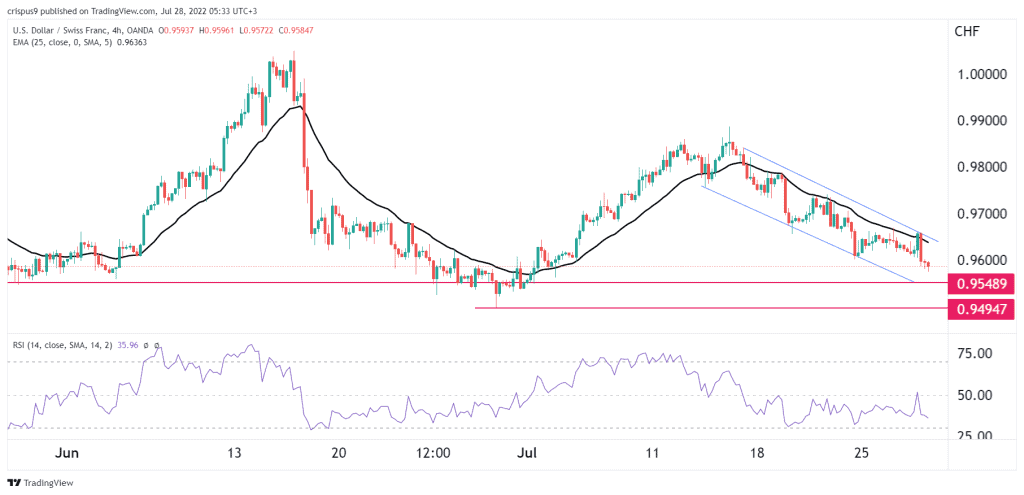

The USD/CHF price dipped to the lowest level since July 4th as investors reflected on the interest rate decision by the Federal Reserve. The USD to CHF exchange rate dipped to a low of 0.9582, which was about 3.025 below the highest point this month and 4.55% below the highest level in June this year.

US GDP data ahead

The USD/CHF pair declined after the Federal Reserve decided to hike interest rates by 0.75% on Wednesday. The bank reiterated that the giant hike was necessary to fight the red hot inflation that rose to over 9.1% this month. At the same time, Jerome Powell reiterated that the bank was not aiming to cause a recession.

The Fed decision came a few weeks after the Swiss National Bank (SNB) surprised the market by hiking interest rates by 0.50%. Analysts were expecting the bank to simply warn that it will hike rates. Besides, the SNB has been one of the most dovish central banks in the world. Now, the spread between US and Switzerland bond yields has continued widening, creating a real carry trade opportunity.

The next key catalyst for the USD to CHF exchange rate will be the upcoming US GDP data. Analysts expect the numbers to show that the American economy expanded by 1.5% in the first quarter. If they are accurate, the US will have avoided a technical recession, which happens when an economy drops in two straight quarters.

USD/CHF forecast

The four-hour chart shows that the USD/CHF pair has been in a strong downward trend in the past few days. The price remains significantly lower than the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved slightly below the neutral point at 50. It has formed a descending channel that is shown in blue.

Therefore, the pair will likely continue falling ahead of the US GDP data. If this happens, the next key support level to watch will be at 0.9548. A move above the resistance at 0.9600 will invalidate the bearish view