- Summary:

- Ankr price has tracked the performance of other cryptocurrencies in the past few weeks. We explain what to expect.

Ankr price has tracked the performance of other cryptocurrencies in the past few weeks. In June, the coin crashed to a low of $0.0229 as Bitcoin declined below $18,000 for the first time since 2020. It is now trading at $0.029, which is about 29% above the lowest level in June. Its market cap has risen to over $230 million.

Why is Ankr rising?

Ankr is a leading player in the blockchain industry. It offers a useful product known as a Remote Procedure Call (RPC) for endpoints. Ankr is available across several popular chains like Ethereum, Polygon, Avalanche, Harmony, and Near Protocol, and BNB. On a given day, the network handles over 7.2 billion API requests by over 39,000 developers.

Ankr Price has done well in the past few days as cryptocurrency prices and American equities have bounced back. The Dow Jones and Nasdaq 100 are on track for their second straight weekly gain even as concerns of a recession remained. In most cases, Ankr tends to rise when other cryptocurrencies and stocks are rising.

Ankr is also rising as investors cheer the recently launched Ankr App Chain, which is a plug and play tool to build a blockchain. Using the network, it is possible to launch blockchains about 10x faster. Analysts believe that the coin will likely gain more traction as more developers come to the network.

Ankr price prediction

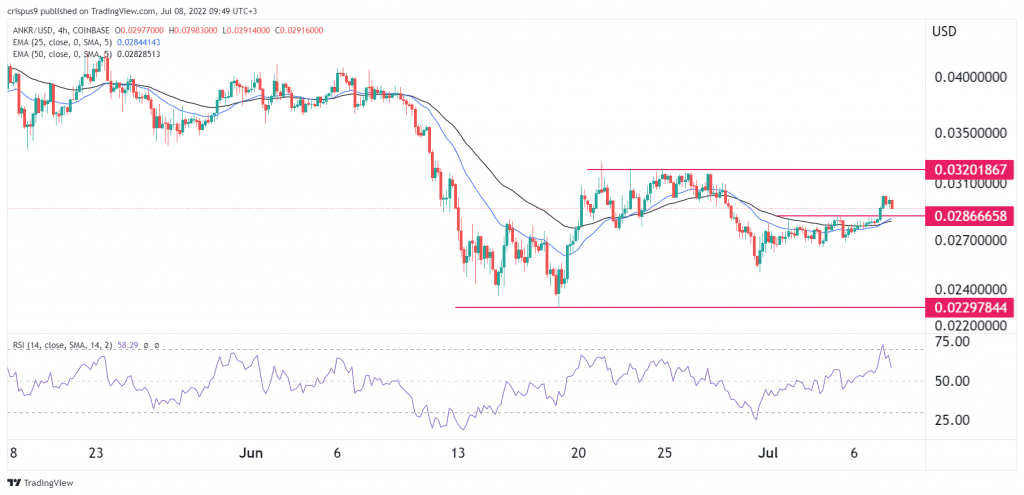

The four-hour chart shows that the Ankr Protocol price has been in a slow upward trend in the past few days. The coin has managed to move above the important resistance point at $0.028, which was the highest point on July 5th. It has moved above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved close to the overbought level.

ANKR is attempting to form a break and retest pattern. In price action analysis, a break and retest pattern is usually a bullish sign. Therefore, the coin will likely continue rising as bulls target the key resistance point at $0.0320, which was the highest point in June. This view will be invalidated if the price moves below the support at $0.028.