- Summary:

- The Harmony One price predictions have not tilted to the upside, as funds stolen from the Horizon Bridge remain missing.

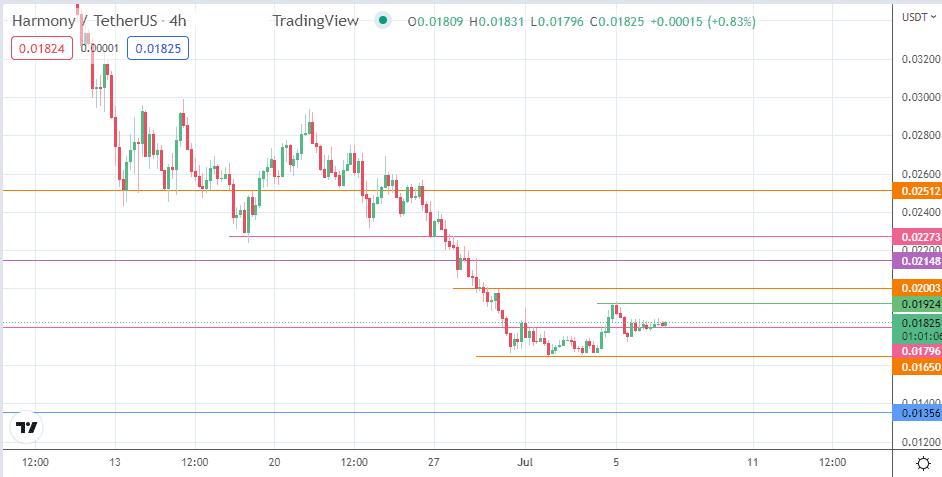

Harmony One price predictions have not significantly improved despite yesterday’s 1.28% gain. The ONE/USDT pair remains under pressure, with the support level at 0.01796 remaining under pressure. Price action on the Harmony One token’s pairing with Tether continues to trade in a narrow range which presently has the 0.01850 price mark as the ceiling.

After seeing lows at 0.01650, the token has experienced some short-term gains since. But these gains were capped at the 0.01924 resistance, leading to a slight selloff triggered by the recent crypto slide on Tuesday. In addition, bullish Harmony One price predictions were heavily dented after the $100m hack of its cross-chain bridge, Horizon.

The major security breach of the Horizon bridge, which connects the Harmoney Network to Ethereum and the Binance Chain, was confirmed in a 24 June tweet. The 15-hour exploit is being blamed on the renegade Lazarus Group, a state-sponsored hacking group that has been fingered in several exploits of blockchain networks in the past.

The company is working with law enforcement agencies to track down the stolen funds, which have so far not been passed through any masking processes.

Harmony One Price Prediction

The charts show that the 0.01796 support is highly vulnerable at this point. A decline below this level gives the bears access to the 0.01650 support (2/3 July lows). Further support is located at 0.01356, formed by the previous high of 15 August 2020 in role reversal.

If the bulls leave this support undefended, the bears will continue the march toward the 0.00751 pivot (13 February 2020 and 22 January 2021 highs). Additional targets to the south are present at the 0.00438 support (31 December 2020 low) and the all-time low at the 0.00136 price level.

On the other hand, a bounce on the support at the 0.01796 price mark allows the bulls some respite, with 0.01924 (4 July 2022 high) and 0.02148 (10 February 2021 high and 28 February 2021 low) serving as the immediate northbound targets. The potential of the 0.0200 psychological resistance serving as an intervening pitstop before 0.02148 remains.

If the bulls achieve clearance of this resistance, it gives access to 0.02273 and the 17 February 2021/15 June 2022 lows at 0.02512. Fresh targets to the north come in at 0.03000 (psychological barrier and 26 February 2021/16 June 2022 highs) and at 0.03517 (20 February 2021 high).

ONE/USDT: 4-hour Chart