- Summary:

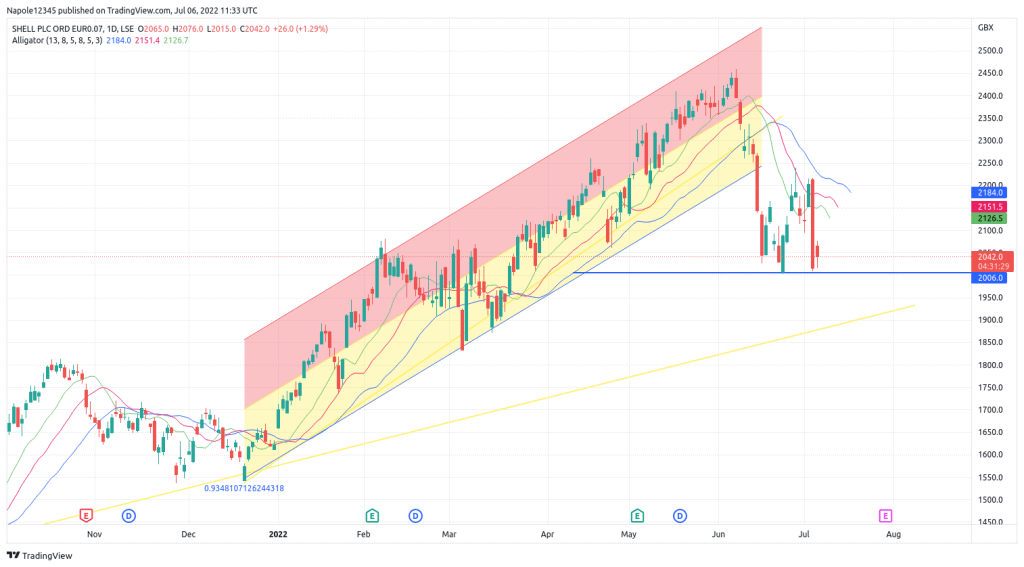

- In yesterday's trading session, Shell share price dropped by eight percent and that trend is looking likely to continue today.

The Shell share price dropped by 8 per cent in yesterday’s trading session. Today, the prices are looking highly likely to continue with the aggressive bearish trend, after the shares slipped by over two per cent, before recovering in the last few hours.

Shell Share Price Action Context

Despite dropping by more than 8 per cent yesterday, and looking highly likely to continue with the bearish trend today, Shell’s share price trend is still aggressively bullish when looked at in a wider context.

The year-to-date data shows that the prices are up by 19 per cent. The company’s profits have also tripled, rising from $3 billion in the first quarter of last year to over $9 billion. According to a recent forecast, the company is also expected to make around $35 billion in profits this year, which will be more than $15 from the previous year.

Shell Share Price Analysis

Despite having aggressive yearly bullish numbers, the past few days have resulted in losses in the markets. Part of the reason is due to the current pullback in oil and gas prices, which has created uncertainty around how much a company’s share price can hold if oil and gas prices continue to slide in the markets.

Therefore, my share price expectations for the next few trading sessions expect it to react to the market conditions. If the price of crude oil continues to fall, as is currently the case, then there is a high likelihood that we will see Shell’s share price continue to dip.

However, if the oil prices fail to moderate, and crude oil recovers its lost prices, there is a high likelihood that we will see the starting to rise. There is also the other factor, Russia’s invasion of Ukraine and the ensuing sanctions, that has affected the industry. If the current sanctions continue to create shortages across Europe, then there is a high likelihood that we will see Shell share prices recover.

Shell Share price