- Summary:

- The NZD/USD pair is aiming for a higher push ahead of the RBNZ decision. Clearance of the 0.6220 price mark assures this.

The NZD/USD pair is trading higher this Wednesday as traders ratchet up bets of a rate hike by the Reserve Bank of New Zealand (RBNZ) when it makes its decision known on Tuesday, 12 July. The uptick follows the rejection of the low at the wedge’s lower border and the 0.61548 support level.

The RBNZ is projected to raise interest rates by 50 bps in its next meeting to curb rising inflation. This will be the first interest rate decision by the new RBNZ board that took office on 1 July. The board came into effect due to changes in the law establishing the RBNZ in 2021. RBNZ Governor Adrian Orr will chair this new statutory board that was set up to shift the bank to a more conventional model.

The rate hike expectations would be battling recession fears that beat back risk-associated currencies such as the Kiwi Dollar in Monday’s trading session. Furthermore, there are some indications that the RBNZ may opt for a softer approach to rate hikes going forward if it delivers the 50 bps increase. So far, bullish action on the day appears muted, even as the price action aims to complete the pattern to take the NZD/USD higher.

NZD/USD Forecast

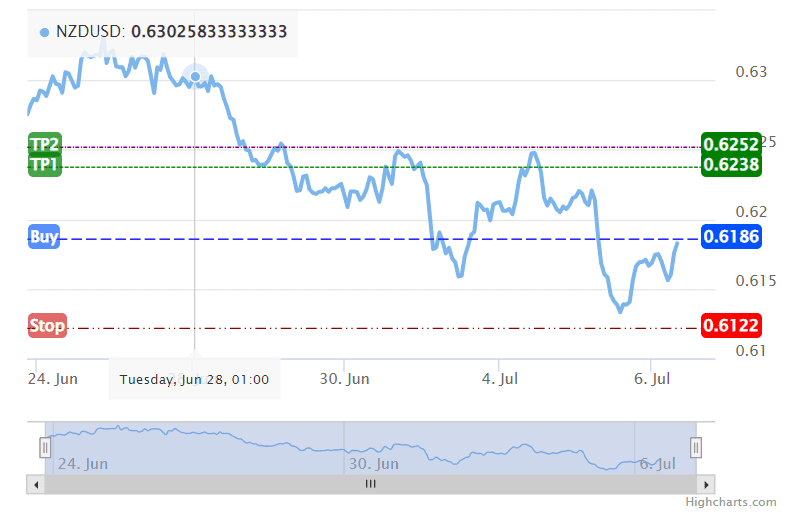

The progressively higher lows seen on the chart below indicate that selling pressure may have been exhausted. The daily chart (not shown) displays a falling wedge pattern with bullish connotations. The Investingcube S-R indicator has 0.6168 as the Buy entry point. The Take Profit targets are 0.6238 and 0.6252, with the latter being the lows of 22 June/23 June and recent highs seen on 29 June to 1 July.

A better entry may be to wait for the break of the wedge’s upper border at 0.6220. If the measured move of the wedge plays out, the price action may go as high as 0.63820. This move must achieve clearance of the intervening barrier at 0.62835. The stop loss is at 0.6122, which is 1 pip below the 5 July 2022 low.

A break of the stop loss opens the door for a contrarian trade to the south, as this move takes out the wedge’s lower border and invalidates the pattern. 0.60464 becomes the immediate downside target, being the site of the 19 May 2020 low. Further price deterioration targets 0.60072, the site of the 6 May 2020 low that acts as a psychological support mark. The 18 May 2020 low at 0.59207 rounds off potential targets to the south.

NZD/USD Chart