- Summary:

- The GBP/AUD trades higher after a less hawkish-than-expected statement from the Reserve Bank of Australia (RBA).

The GBP/AUD is trading higher on the day as risk aversion seizes the markets this Tuesday. However, the pair has ceded some of the earlier gains and now trades 0.13% higher. The uptick of the pair comes after the Reserve Bank of Australia elected to raise interest rates by 50 bps early Tuesday morning.

The interest rate rise met market expectations. In the statement by the RBA Governor Philip Lowe, the bank noted that inflation was high and boosted by COVID-19-related supply chain disruptions and the war in Ukraine. However, the RBA noted that Australia’s inflation was not as high as in other countries, and that the steady unemployment rate and significant fall in underemployment would continue.

The RBA’s statement concluded by saying that the size and timing of any further rate adjustments would be guided by data and additional assessment of inflation and labour market conditions. This statement was interpreted as being less hawkish than the markets expected, weakening the Australian Dollar against the Pound. Risk aversion in the markets also means that the commodity-dependent Aussie Dollar was less likely to see demand than its peers.

GBP/AUD Forecast

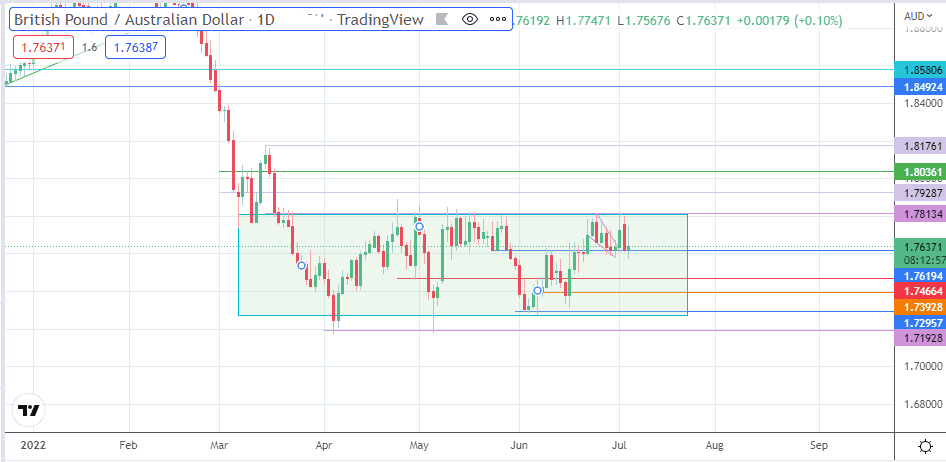

The intraday uptick from the 1.76194 price mark needs to break the rectangle’s upper border at the 1.78134 resistance level. This break will allow the bulls to aim for the 1.79287 price mark. Above this level, the 1.80361 resistance (17 March 2022 high) will become available. The high of 15 March 2022 at the 1.81761 resistance mark forms an additional northbound target available on a price advance.

On the flip side, a decline below the 1.76194 support allows the 1.74664 support (9 May low and 2 June high) to become the next target for the bears. Below this level, 1.73298 is the next downside target. This is the last obstacle before the bears can attain the double bottom’s day one trough at 1.72957 (7 June low). Finally, further price depreciation lets the 1.71928 support level (lows of 5 April and 5 May 2022) enter the mix as another target to the south.

GBP/AUD: Daily Chart