- Summary:

- The Sandbox price is down today, after having one of its best days in weeks yesterday, when it surged by 14 percent.

The sandbox price is down by 4% in today’s trading session. The drop comes a day after the crypto had one of its best days in months, after surging by 14 per cent in Yesterday’s trading session.

Why did Sandbox’s price surge Yesterday?

The Sandbox price surge in Yesterday’s trading session came as a surprise to many. The project has had no market-moving headline in the past week. The project has also not made any changes that could have impacted it so much that it had to rise by 14 per cent.

However, looking at other data points, the project’s trading volume is up by over 150 per cent. Normally, an increase in trading volume can result in prices going up. But, looking at the data, a 150 per cent increase is big enough to cause the markets to move at the rate it did in Yesterday’s trading session.

Sandbox Price Prediction

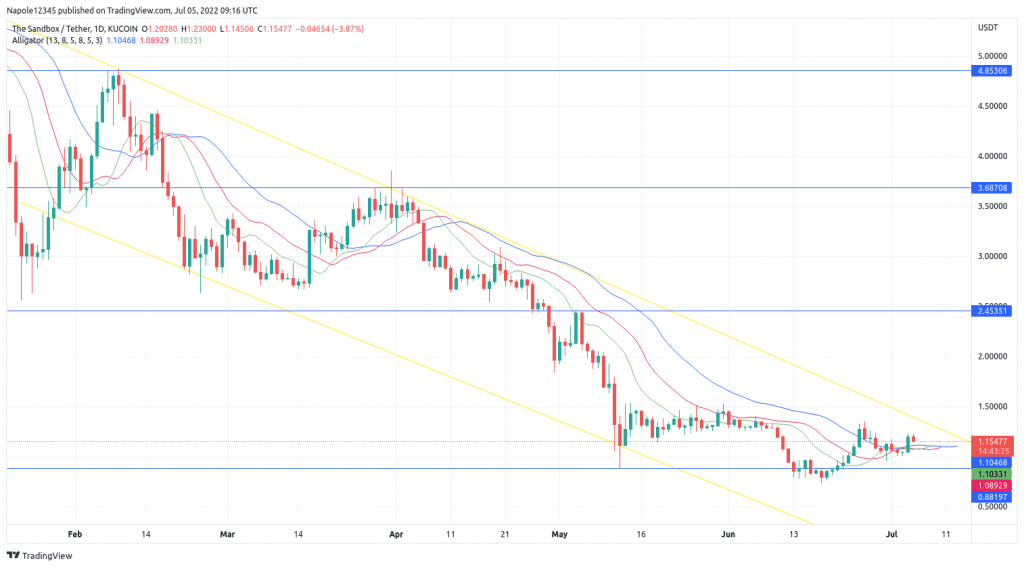

Today, the price of Sandbox is down by 4 per cent. Looking at the daily chart below, today’s price drop also looks likely to continue falling throughout the session.

However, today’s price drop may be a correction of Yesterday’s strong aggressive move to the downside. Therefore, my Sandbox price prediction expects the resumption of the bullish move in the next few trading session. Although the prices may close today’s trading session at a lower level than it is currently trading, I expect the strong bullish trend that started two days ago to persist and become a long-term trend. Therefore, my price level expectation for the bullish price reversal is a $1.4 price level.

Part of the reason why I expect the prices to pick up again is due to the latest traction that saw the trading volume surge by over 150 per cent. When such an interest in a cryptocurrency project occurs, there is always a high likelihood of the trading volume continuing to rise, pushing the prices up. There

On the flip side, if the prices trade below a dollar, there is a high likelihood that we have entered a bear market.

Sandbox Daily Chart