- Summary:

- Shell share price is up by 1.5 percent in today's trading session, continuing a strong bullish trend that has lasted for 10 days.

The Shell share price is up by 1.5 per cent in today’s trading session. The price increase is a continuation of the strong bullish trend seen over the last ten days, during which prices have risen by 7 per cent.

Why is Shell’s Share Price Rising?

The energy sector has faced challenges this year due to the ongoing war in Ukraine. Russia, being a top exporter of energy in Europe, has seen its products sanctioned due to the war. The result has been shortages across Europe, with prices of the commodity surging.

With the demand for oil being high and Shell’s competitors being sanctioned, the company’s year-on-year profits have jumped from $3.9 billion last year to the current $9 billion in quarter one. The oil price is also not expected to return below the $100 per barrel mark in the near term, which will see Shell earnings continue to rise.

According to Shell Plc Chief Executive Officer Ben van Beurden, the current oil shortage is also not expected to end soon. Beurden, in an interview in Singapore, added that the tightening supplies of liquified natural gas and oil are also contributing to the current energy crisis. He added that, although Europe as a region expects to import more gas from outside, he was pessimistic about whether the imports would be able to meet the demand left after Russia’s sanctions.

Shell Share Price Analysis

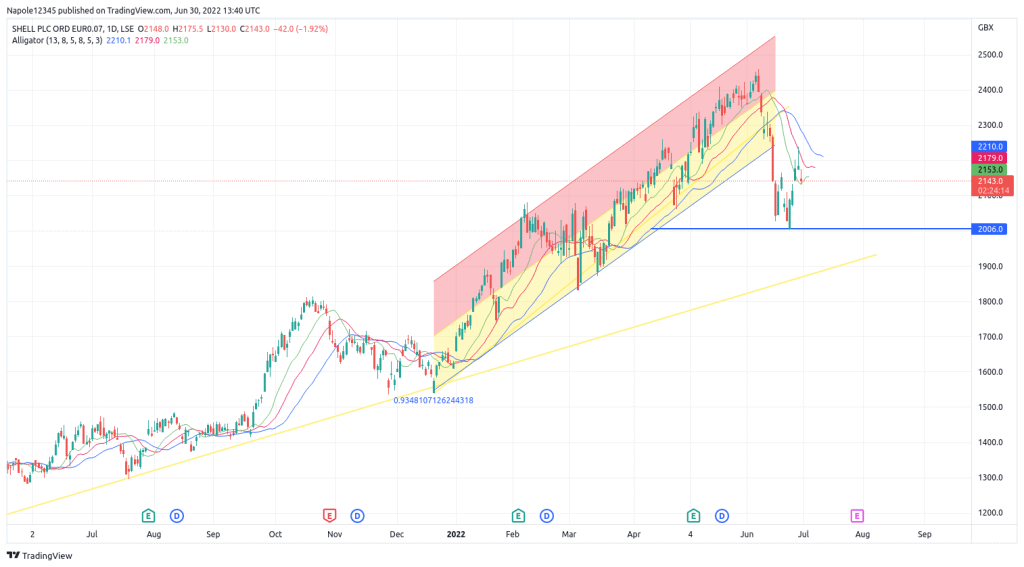

The current energy shortages worldwide will continue to impact Shell’s share price and push it upwards. Therefore, I expect the prices to start trading above the 2,300p price level in the coming session.

There is also a high likelihood that we may see prices return to trading above the 2,400p price level in the next few weeks and set a new yearly price high.

On the flip side, investors looking to get into trade will be able to buy the share prices at a discount after the share prices dropped by 15 per cent in the early days of the month. Currently, the prices sit at 9 per cent below the June open price.

Shell Daily Chart