- Summary:

- The GBP/ZAR is soaring this Wednesday after consumer confidence data in South Africa slumped to its 2nd lowest level in 30 years.

The GBP/ZAR is trading higher for a third straight day after investment flows continued out of emerging markets. Fears of a global recession are scaring investors away from riskier currencies such as the South African Rand, with a push towards safe-haven assets such as the US Dollar and Swiss Franc taking centre stage.

The earlier dovish comments of BoE Governor Andrew Bailey and an incoming BoE member at a hearing before the UK Parliament’s Treasury Committee may have dampened the Pound in its pairing with other major currencies, but it remains strong against the Rand.

The South African economy is still in the doldrums. Evidence of this lies in the resumption of load shedding and a decline in the South African consumer confidence figures. Consumer confidence plunged from -13 to -25 in Q2 2022, which is the lowest it has been in thirty years (not accounting for Q2 2020 when the COVID pandemic raged). The data further strengthened the Pound’s standing against the Rand. The GBP/ZAR is trading 0.68% higher as of writing.

GBP/ZAR Forecast

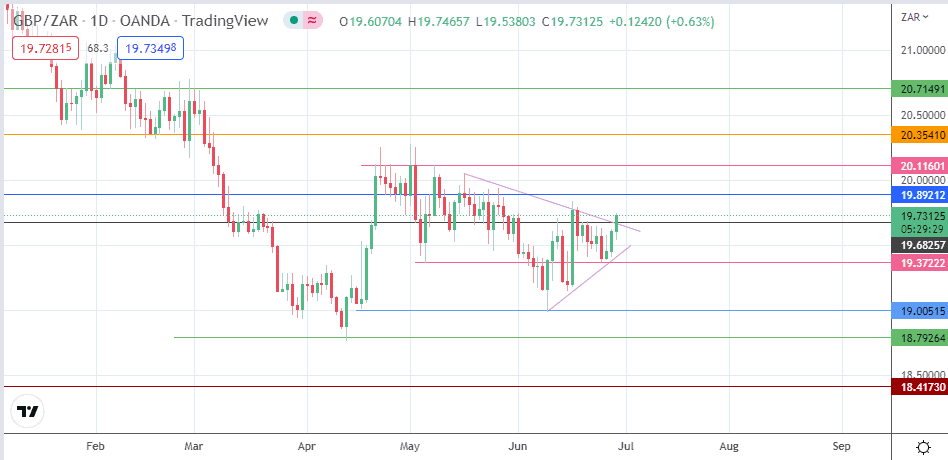

The daily candle’s uptick has rendered the 19.68257 resistance vulnerable. A break above this level targets the 19.89212 barrier, breaking the triangle to the upside. The measured move following the breakout will seek termination at 20.35410 (13 October 2021 and 7 March 2022 highs). To get there, the bulls must uncap the intervening barrier at the 20.11601.

Above the completion point, a further advance targets the 20.71491 resistance, where the 25 January and 1 March highs reside. Conversely, rejection at the 19.68257 resistance targets the 19.37222 support level. Additional support is seen at 19.00515 (18 April and 9 June 2022 lows) following a price decline. Additional price deterioration brings 18.70264 (13 April 2022 low).

GBPZAR: Daily Chart