- Summary:

- The Vodafone share price could be set for a correction toward $115 if the bearish flag comes to play as expected.

The Vodafone share price is primarily unchanged this Friday, following yesterday’s 1.22% gain that kept the price within the range formed by this week’s price action. This scenario comes as the company prepares to spin of its Internet of Things (IoT) division, creating a new company which gave Vodafone 900 million in 2021.

Vodafone says that allowing the unit to become an independent company will accelerate the growth and attractiveness of the platform. The Vodafone share price surged early in the month after it posted higher-than-expected revenues from its African and European service divisions.

However, it has provided cautious forward guidance for 2022, as it envisages inflation to pose a headwind to its business growth. In mid-May, the Vodafone share price benefitted from the sale of 9.8% of its equity to a UAE-based telecoms firm, raising $4.4 billion in the process. Investors have been pushing for the firm to enter into such deals, but the management has sealed very few.

Vodafone Share Price Forecast

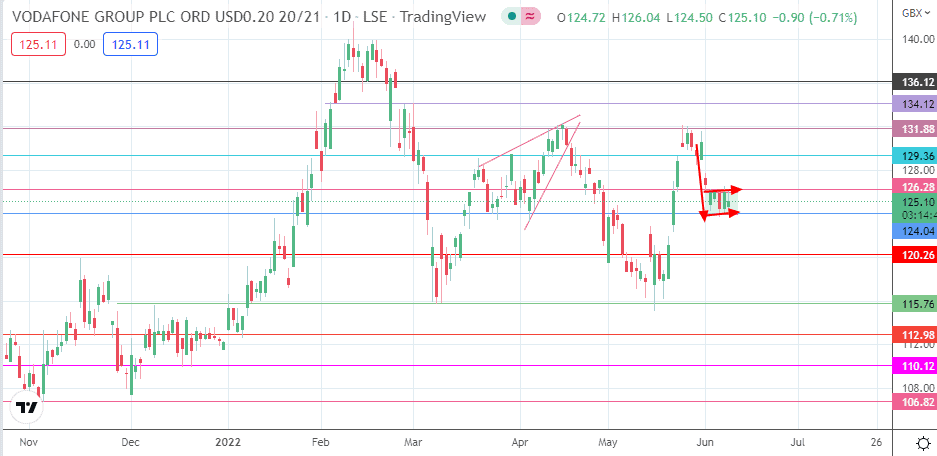

The consolidation between the 126.28 resistance and the 124.04 support forms the flag. A breakdown of the 124.04 support (24 March and 9 June lows) completes the pattern and opens the door to a measured move that will aim for completion at 115.76 (11 January 2022 and 9 March 2022 lows).

However, the 120.26 support (11 March and 18 May 2022) stands as an obstacle, and the bears must take out this price mark for the completion point to be attained. The 19 November 2021/7 January 2022 lows at 112.98 16/20 December 2021 lows at 110.12 form an additional price target to the south.

On the flip side, if the bulls can force a break of 126.28, the pattern will be invalidated. This move will clear the pathway toward 129.36 (30 March and 22 April highs). 131.88 (19 April and 265 May highs) and 134.12 (25 February 2022 high) form additional targets to the north, which become viable when the 129.36 resistance level is uncapped.

Vodafone: Daily Chart