- Summary:

- Terra Luna price is up by 5 percent in today's trading session. However, since its launch, Luna has dropped by 70 percent.

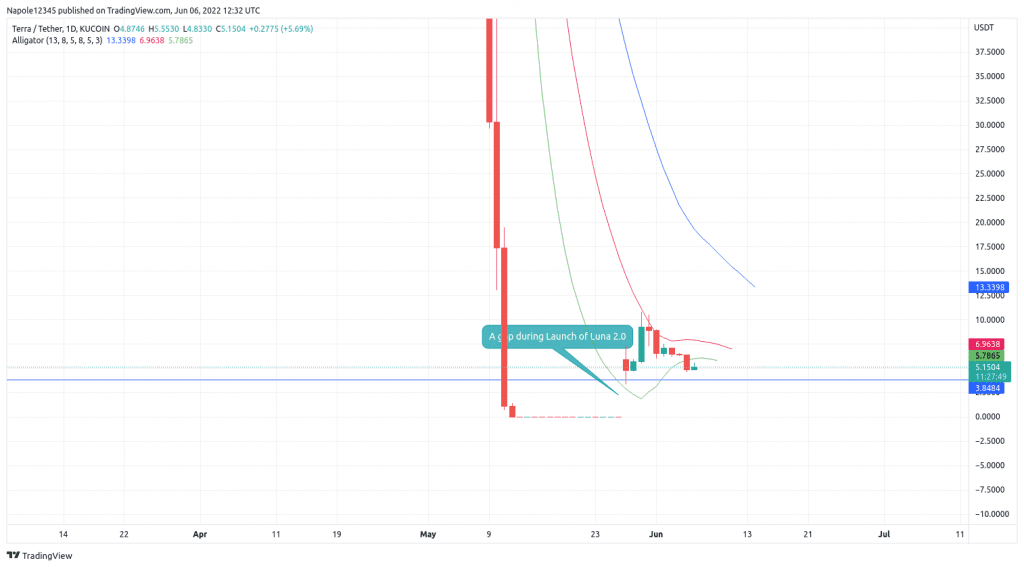

The launch of Terra Luna 2.0 was expected to revive a project that, a day before its collapse, had a market capitalization of $27.8 billion. However, Since its launch on May 28th, the prices of Luna 2.0 has continually plummeted and are already down by 70 percent from what it was trading in its first trading session.

Despite responding in the markets positively after Binance announced it would be accepting Luna 2.0 on its platform, which led to a 63 percent trading session, the prices quickly plummeted. The launch of Luna 2.0 was also supposed to give reprieve to earlier investors Luna, who lost over $40 billion when both Terra Luna and UST collapsed. This was to be achieved through airdropping the tokens to previous Luna holders.

However, according to reports, the airdrop has been poorly structured and is mainly focusing on Luna holders over savers or bond holders such as Anchor depositors or UST holders. The Luna 2.0 prices have also been pushed down by people receiving the airdropped tokens. Most of the receivers are selling their tokens to try and recover some of their money. The result is a market where most people are sellers, and few buyers exist.

Luna 2.0 Price Prediciton

Luna 2.0 is up by 5 percent in today’s trading session. The cryptocurrency has been trading aggressively downwards since May 30th, when Luna 2.0 rose by 63 percent. The price surge came amidst an announcement by Binance that the token would be listed on their platform. As a result, there was hope by previous investors of Luna, who would now be able to receive airdropped tokens and recover some of their losses.

However, fast forward from the May 30th price surge, the cryptocurrency has continually underperformed the cryptocurrency market. The prices have also performed poorly and failed to meet expectations for quick recovery.

Therefore, my Luna 2.0 price prediction expects the prices to continue falling. My long-term outlook is the prices will trade below the $3 price level. It is also likely that, in extreme circumstances, we may see Luna 2.0 trade below $1.

However, if the Luna 2.0 ever sets a new price high above $18, my long-term analysis will be invalidated. Though unlikely, it will also mean recovery, and a strong bull move to the previous Terra Luna levels is possible.

Luna 2.0 Daily Chart