- Summary:

- The S&P/ASX 200 index is crawling back as investors react to the latest Australian election and the set of policies proposed by the PM

The S&P/ASX 200 index is crawling back as investors react to the latest Australian election and the set of policies proposed by the prime minister. It is also rising ahead of the upcoming interest rate decision by the Reserve Bank of Australia (RBA). The ASX 200 is trading at $7,173, which is about 4.4% above the lowest level this month.

Australian stocks are moving upwards after Australians decided to change their government last week. In the election, they decided to elect Anthony Albanese of the Labor Party. The new premier has made several proposals such as raising wages and helping transition Australia into a clean energy powerhouse. He has also pledged to engage with China to ease the existing trade barriers.

The ASX 200 index is also rising after the strong Australian retail sales. Sales surged to a record high as more Australians spent money on food, cafes, and restaurants. As a result, the Australian dollar also made a strong recovery against the US dollar while government bonds inched upwards. Focus now shifts to next month’s RBA rate decision as investors expect more tightening.

The worst performing shares in Australia were companies like CSR, Incitec Pivot, Mercury, Champion, and Nine Entertainment. All these stocks fell by more than 1.50%. On the other hand, the best performers were firms like Block, Paladin Energy, Core Lithium, Pilbara Minerals, and Corporate Travel Management. Appen share price tumbled by over 23% after its acquisition by Telus faltered.

S&P/ASX 200 index forecast

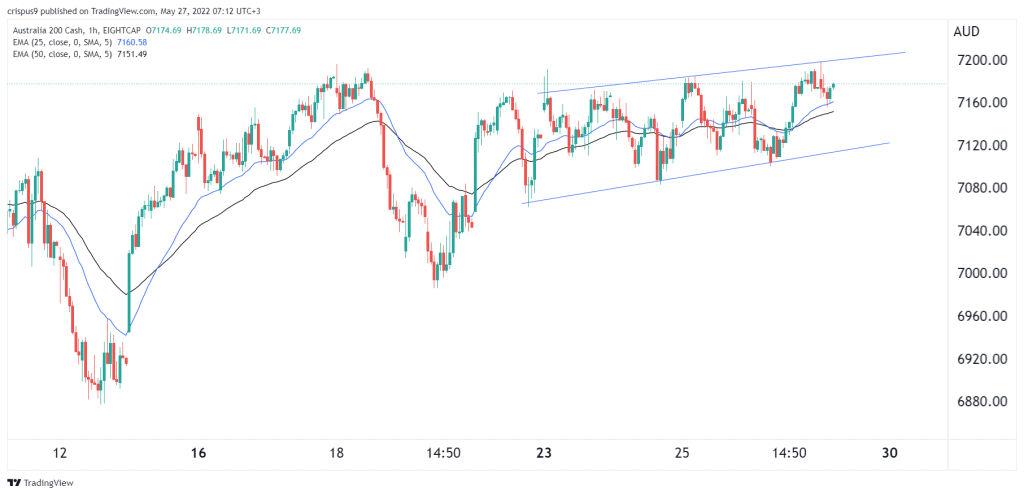

Turning to the hourly chart, we see that the ASX 200 index has been in a bullish trend in the past few days. Along the way, the index has formed an ascending channel that is shown in blue. It is now hovering slightly below the upper side of this channel. The index is also being supported by the 25-period and 50-period moving averages.

Therefore, the index will likely continue rising in the next few sessions as investors target the key resistance level at $7,200. The alternate scenario is where it starts falling and retests the lower side of the channel at 7,120.