- Summary:

- What is the outlook of the Tata Teleservices share price? We explain what to explain why the TTML is a good buy or sell.

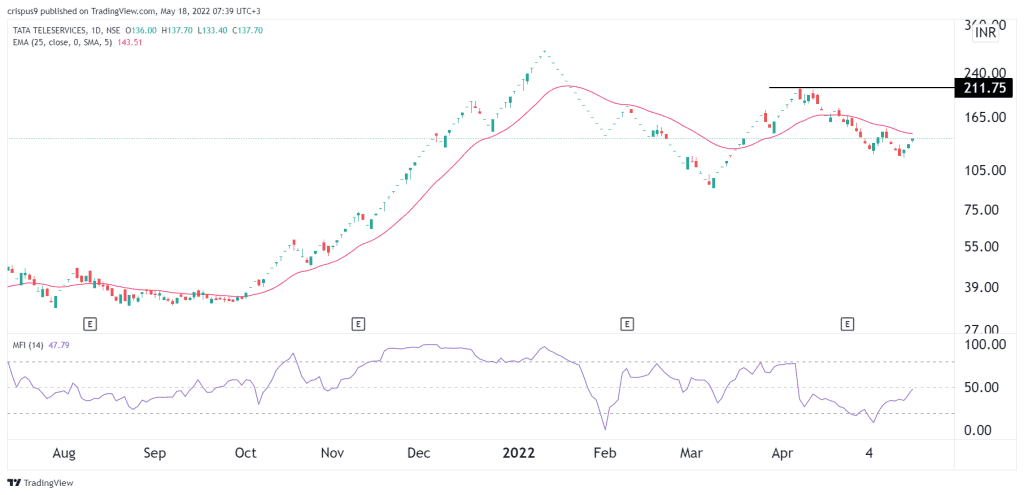

The Tata Teleservices share price has ticked upwards in the past three days straight as Indian stocks stage a steady recovery. The TTML stock is now trading at 137, which is slightly above last week’s low of 117.6. However, the shares remain about 54% below the highest level this year and 1,615% above the lowest point in 2021.

Tata Tele Business Services is a leading Indian company that is part of the Tata Group. Tata is one of the biggest conglomerates in India that owns businesses in the consulting, automobile, steel, and chemicals businesses. The company provides multiple services to some of the biggest companies in India.

As the world moves towards a digital industry, the company provides solutions that are essential in improving efficiency. For example, it helps companies move to the cloud and secure their networks. It also offers voice solutions to companies of all sizes.

However, the main challenge for the company is that there are signs that some of these industries are slowing down after recording strong growth during the pandemic. There is also the challenge of rising competition in India, with companies like Jio, Infosys, and Wipro providing some of these solutions. But, most importantly, the firm has continued to make losses as costs rise in the past few years.

Tata Teleservices share price

Turning to the daily chart, we see that the TTML shares are thinly traded in Mumbai. Further, the stock has been in a downward trend from its highest level at 211 that it reached in April. It has also moved slightly below the 25-day moving average, while the money flow index (MFI) has moved above the neutral level.

Therefore, as I noted last week, the Tata Teleservices shares will likely continue dropping in the near term. A drop below the important support cannot be ruled out. On the other hand, a move above 150 will invalidate the bearish view.