- Summary:

- Tether is currently pegged at a ratio of 1 to 1against the US dollar. However, the recent implosion of UST has led many to believe that USDT

Tether is currently pegged at a ratio of 1 to 1against the US dollar. However, the recent implosion of UST has led many to believe that USDT may be in a similar fate in the future.

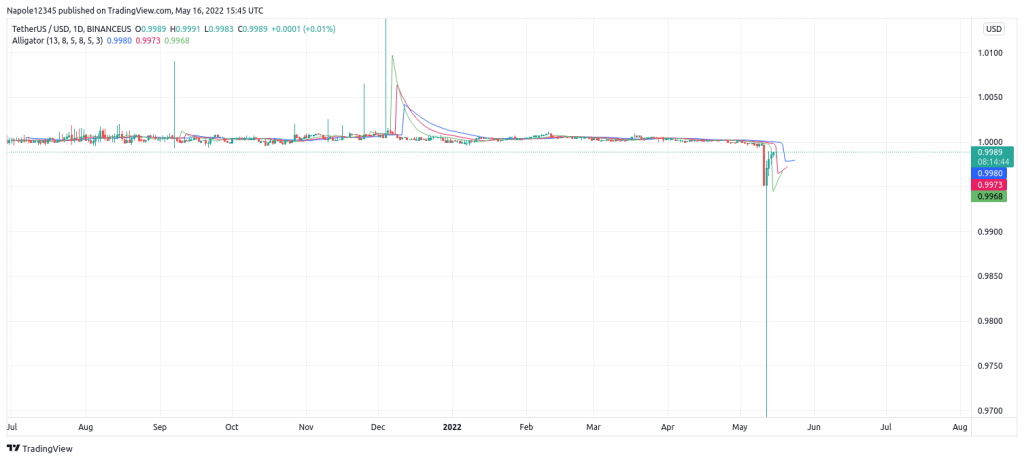

On May 12, something unique that has not happened to Tether since December 2022, occurred, USDT untethered from the USD. The price of Tether fell by six cents and traded at 95.55 cents. The tensions started to rise across the markets, as traders struggled with the thought of the largest stablecoin de-pegging.

In the markets, tensions were still high after UST had dropped by 99 per cent. For context, UST is one of the most popular stablecoin. However, last week, the stablecoin started falling after hundreds of millions of the stablecoins were injected into the platform. This resulted in increasing minting of Luna because UST was an algorithmic coin that relied on the token. The result was a meltdown in the cryptocurrency industry.

Today, however, the prices of Tether are trading at a dollar. Tether’s CTO has also come out with a statement to investors, assuring them that USDT is not likely to suffer the same fate that UST suffered. At the time of the 99 per cent drop, UST was the third-largest stablecoin in the market. The drop has left many worried, while others, such as US regulators have become nervous after the stunning collapse of Terra.

Tether Price Prediction

My Tether price prediction expects the prices to remain pegged to the dollar. I also do not expect a sudden crash like seen in the UST stablecoin. This is because Tether is not an algorithmic stablecoin. Therefore, they ensure that their stablecoin is backed by assets in a 1:1 ratio with the total amount of tethers in the market.

However, I do expect regulations on stablecoins to start being implemented across the US and possibly in other parts of the world. U.S. Treasury Secretary Janet Yellen has already urged Congress to approve federal regulations on stable coins following the recent UST debacle.

Tether Daily Chart