- Summary:

- Is the BCH price recovering or is a bigger drop on the way? Here is the Bitcoin Cash price prediction for the weekend.

Bitcoin Cash has managed to push itself off its intraday lows and is up marginally as traders justle to seek the best possible prices to re-enter the token. However, the recent decline in the crypto market has smeared the arena with bearish Bitcoin Cash price predictions.

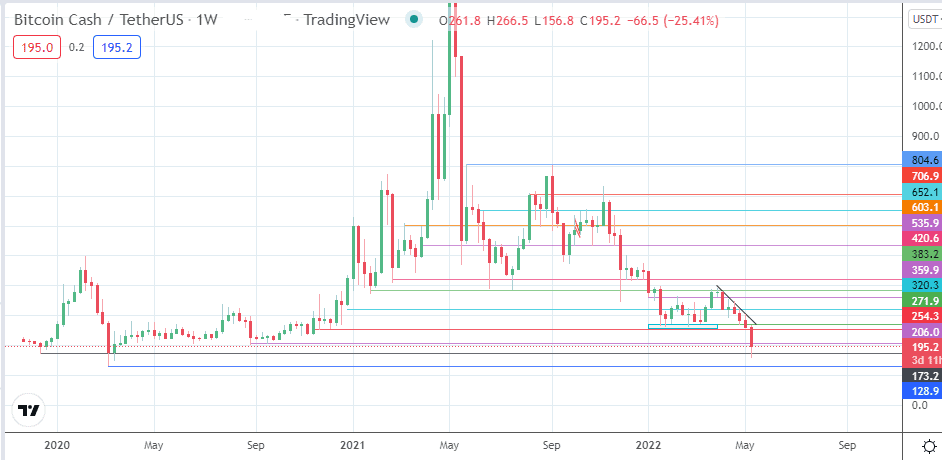

The BCH/USDT pair is down 29.92% this month, adding to April’s 27.74% decline. This puts the pair in a downtrend, following the break of the support zone between 254.9 and 271.9. So far, Bitcoin cash has tested a price point just above the 1 March 2020 low at 129.0.

Consumer price index data from the US for April had strengthened a case for the Fed to take more hawkish action regarding interest rates. The data strengthened the US Dollar, as it touched off levels not seen since 2002. Its correlated asset Tether also garnered strength, sending the BCH/USDT pair lower. However, some bargain hunting has come in at the start of the US session, sending Bitcoin, Bitcoin Cash and other correlated assets slightly higher on the day.

However, the sentiment remains bearish, and we could see more Bitcoin Cash price predictions, especially if the bulls are unable to keep the pair above the 206.0 price mark.

Bitcoin Cash Price Prediction

The intraday bounce has enabled Bitcoin Cash to recover from its earlier losses. However, the price action remains below the 206.0 resistance (24 September 2020 low). Therefore, the candle must close above the 206.0 resistance with a 3% penetration, or there must be two successive closing penetrations above this resistance to confirm the break of this barrier.

This opens the door for a further recovery that targets the 254.3 barrier (floor of the former support zone). A further advance will require the bulls to uncap this zone by breaking past the 271.9 resistance (20 April and 5 May lows). This action clears the skies for the bulls to aim for 320.3 (9 March and 26 April highs).

On the flip side, bearish momentum remains if the active candle closes below the 206.0 resistance. 173.2 (17 December 2019 low) will be the immediate target to the south before the 128.9 support (13 March 2020 low) enters the picture as an additional southbound target.

BCH/USDT: Daily Chart