- Summary:

- The Boeing stock price is dipping towards its 2020 pandemic-level lows after another quarter of poor financial results.

The Boeing stock price continues to face pressure from the headwinds created by the downbeat earnings report of Q1 2022. The Boeing Company said it recorded an adjusted loss of $2.75 per share, worse than the 26 cents per share market consensus. This was also a deterioration from the $1.53 loss per share incurred in the same period last year. Revenue was also hit, declining 8% from the Q1 2021 figure of $15.22 billion. The $13.99 billion revenue intake also missed the market estimate of $16.01 billion.

Its downbeat performance has been blamed on lower revenues from its commercial and defence business units. In addition, pre-tax charges that have been incurred as part of the impact of the Russia-Ukraine conflict are also said to be a component of the company’s poor performance.

The poor results extend the Boeing stock price‘s woes, as it is now dipping towards the 2020 pandemic level prices. The company is also yet to see a significant uplift from the resumption of flights its 737 MAX aircraft, which had been grounded for more than two years following two ill-fated crashes.

Boeing Stock Price Outlook

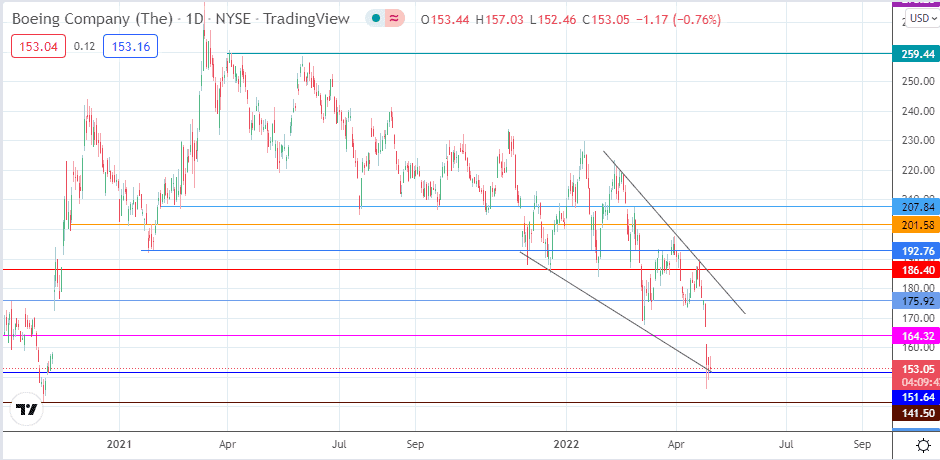

The support level at 151.64 (4 November 2020) remains under severe pressure. A breakdown of this support level opens the door for the bears to make a move on 141.50 (27 May 2020 and 30 October 2020 lows). If the bulls fail to save this support level, further price deterioration occurs, sending the price activity towards the 130.00 psychological support and site of the 1 April 2020 and 19 May 2020 lows. 119.13 rounds off the short-term targets to the south (2 April 2020 low).

On the flip side, a bounce on the 151.64 support level enables a degree of price recovery, which targets 164.32 initially (4 August 2020 and 22 October 2020 lows). An advance above this level enables the bulls to push towards 175.92 resistance (6 October 2020 and 25 April 2022 highs). Additional targets to the north are found at the 186.40 price mark (13 November 2020 high and 25 February 2022 low) and 192.76 (5 April 2022 high).

Boeing: Daily Chart