- Summary:

- USDMXN gives up 0.01% at 19.1148 after stronger retail sales; Mexico Retail Sales (year over year) came in at 2.1% topping expectations of 2% in July

USDMXN gives up 0.01% at 19.1148 after stronger retail sales; Mexico Retail Sales (year over year) came in at 2.1% topping expectations of 2% in July, the monthly reading also came up to 0% in July from previous -0.5%. Stronger figures also came from United States Chicago Fed National Activity Index came in at 0.1, topping expectations of -0.35 in August.The Bank of Mexico cut interest rates for the first time since 2014 by 25 basis points to 8%. I believe that Banxico will continue in that direction with two more rate cuts before the year end.

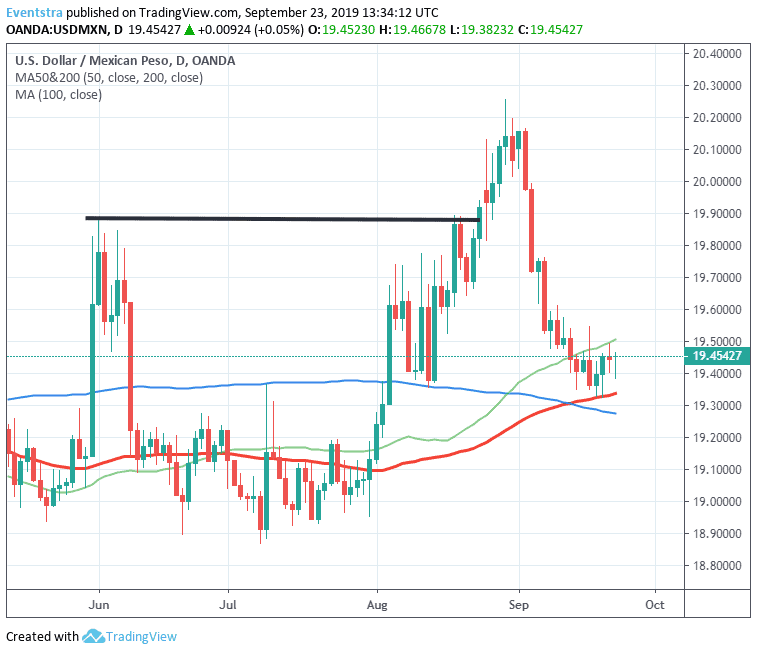

On the technical side the momentum is positive to neutral for the short term as the pair trapped between the 100 and 200-day moving average. On the upside, first resistance stands 19,4635 today’s high then at 20.00 high from September 4th, while more offers will emerge at 20.2573 the yearly high. On the downside immediate support for the pair stands at 19.3823 today’s low and then at 19.3367 the 100-day moving average.