- Summary:

- The Asos share price has resumed the downtrend as it continues to suffer the effects of its poor first half earnings.

The Asos share price looks set to continue the slump it has experienced in the last week following the resumption of trading after the Easter holidays. Sentiment around the stock of the fashion retailer soured when the company said its first-half profits fell 87% on supply constraints in the latest earnings report released seven days ago.

ASOS said supply chain constraints had impacted costs and availability of stocks, despite making 14.8 million pounds in the six months up to 28 February. However, this figure was a far cry from the 112.9 million pounds it made in the same period a year earlier. Revenues rose to 2.0 billion pounds, representing a 4% increase. The company is one of many that stopped sales in Russia following that country’s invasion of Ukraine. The loss of revenue from this market is not expected to significantly impact its full-year guidance, which remains unchanged.

However, the company notes that inflationary pressures were likely to constitute a risk to this guidance if these were to force a reduction in consumer spending. As a result, the Asos share price is down 2.8% as the London trading session inches towards the second hour of trading.

Asos Share Price Outlook

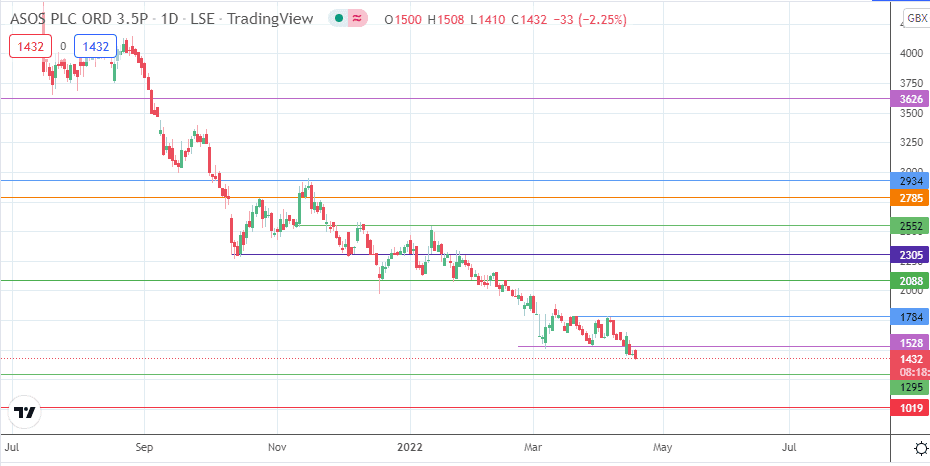

The decline below the 1528 price support (7/28 March lows) has opened the door for a further decline. The 1295 support appears to be the next target, as this is where the price highs of 26 March 2020 are expected to act in role reversal. Below this level, an additional pivot is found at 1019, where the double bottoms of 17 March 2020 and 3 April 2022 are found.

On the flip side, recovery in the stock has to follow a break of the 1528 (support-turned-resistance) and 1784 (21 March/4 April highs). This recovery will target 2088 if the previous resistance areas give way. Additional price targets are 2305, 2552 (7 December 2021/13 January 2022 highs) and 2785 (22 October 2021 high). Failure to reach these last two resistance levels could mean that sellers have found suitable rally points among previous resistance levels to re-initiate the downtrend.

ASOS: Daily Chart

Follow Eno on Twitter.