- Summary:

- EURGBP trades 0.26% lower at 0.8792 making fresh 4-month lows, amid GBP strength across the board on positive Brexit developments. The recent interest rate

EURGBP trades 0.26% lower at 0.8792 making fresh 4-month lows, amid GBP strength across the board on positive Brexit developments. The recent interest rate cut from ECB to -0.50% also weigh on the pair. Eurozone macro data also pressure the euro, today the Germany Producer Price Index (month over month) came in at 0.3%, topping forecasts of -0.2% in August, the yearly PPI reading came in at -0.5%, below forecast of 0.6% for August.

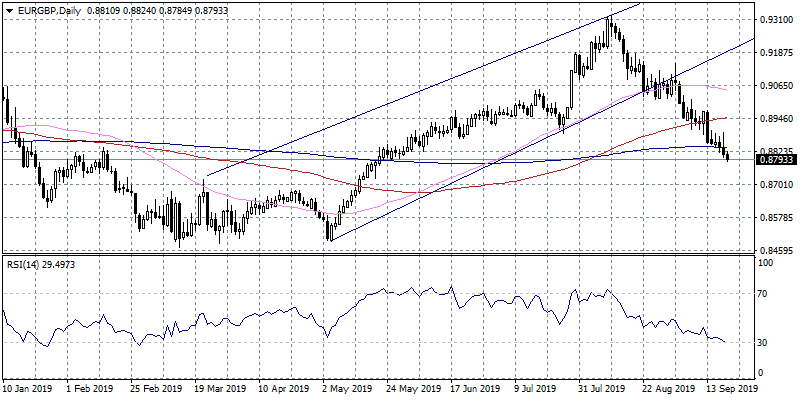

On the EURGBP technical analysis side, the bears now are in control for the short term as the pair trading below all major moving averages. On the downside, first support stands at 0.8784 today’s low, while next barrier is at 0.8723 the low from May 21st. Investors holding short positions can sit comfortably as long as the pair trades below 0.88. The pair has reached oversold conditions as indicated by the daily RSI so a rebound can’t be ruled out. On the upside immediate resistance stands at 0.8824 today’s high, while a break above will open the way for a move up to 0.8946 the 100-day moving average. For those looking to buy the pair, an entry point can be when the pair breaks above the 200-day moving average 0.8837.