- Summary:

- The NEAR Protocol price prediction will depend on whether the bulls can build on the fundamentals to launch a move for $20.

The two-day decline seen in the NEAR Protocol’s price action has stalled this Thursday, with some news that could fuel bullish NEAR Protocol price predictions. This comes as the project announced that it had raised $350m in a new series of funding led by Tiger Global Management. Tiger Global warehouses more than $90billion in assets under management.

NEAR Protocol had raised $150million in January 2022 after receiving interest from several investors such as Andreessen Horowitz and Alameda Research. The additional funding raises NEAR Protocol’s valuation to more than $10billion and makes it one of the top 20 crypto projects by market capitalization.

NEAR Protocol was founded by ex-Microsoft employee Alex Skidanov and developer Ilya Polosukhin. Polosukhin recently fled his homeland Ukraine after the Russian invasion. Now residing in Portugal, he has raised millions to evacuate several Ukrainians from danger and contribute to humanitarian efforts. This has also helped to bring NEAR Protocol to the spotlight.

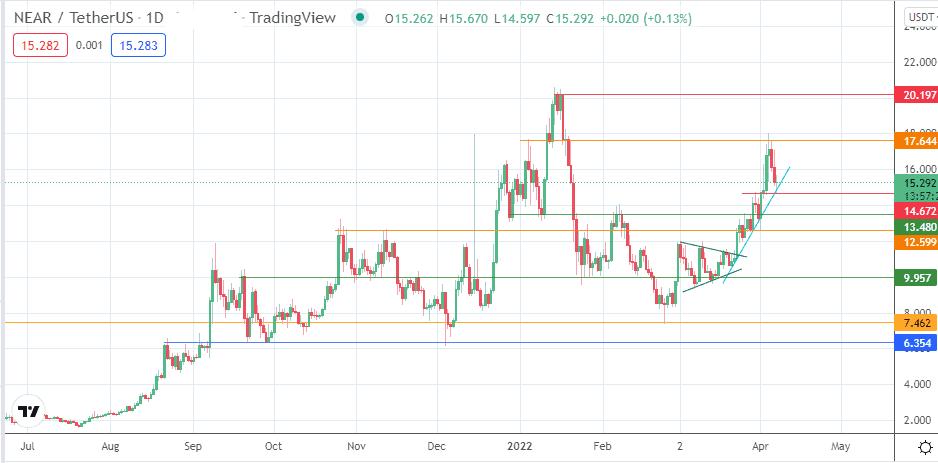

A look at the price action of the NEAR/USDT chart reveals that the crypto token has undergone a rollercoaster. After hitting highs above $20 at the start of the year, it plunged to $7.38 at the start of the Russian invasion of Ukraine. However, it has since gained more than 130% since 24 February, following the breakout from the symmetrical triangle on the daily chart.

NEAR Protocol Price Prediction

The NEAR/USDT price action correction appears to have stalled at the ascending trendline, which connects the lows of recent price action. The active daily candle has bounced off the 14.673 support level and the trendline, preserving the integrity of that price level. If there is additional momentum on the bounce, the 17.644 price resistance becomes the immediate target for the bulls. Above this level, extra resistance comes into the picture at 20.197, where the cluster of highs seen between 12 January and 17 January is found.

On the other hand, a decline below the 14.672 support also takes out the trendline. This scenario would see the bears with an opportunity to take on the next pivot at 13.480. 12.599 and 9.957 are additional price support targets to the south. These would become available if the correction is more extensive.

NEAR/USDT: Daily Chart

Follow Eno on Twitter.