- Summary:

- Citi's price target cut leads to selloff, but the bank's upbeat valuation could boost bullish, medium-term Alibaba stock forecasts.

Bearish Alibaba stock forecasts appear to have crept up on the horizon after Citi bank slashed its 12-month price target on the stock by 12% on Wednesday. Analyst at Citi, Alicia Yap, provided the bank’s latest outlook on the Chinese e-commerce giant’s stock price.

The bank now sees the stock hitting $177 in 12 months instead of its previous target of $200. While this represents a 12% cut in the bank’s outlook, it still leaves the stock with bullish potential, and the Citi analyst believes that the current price levels still make the stock an attractive proposition.

China is currently witnessing a resurgence in its local COVID-19 cases, with Shanghai reporting 13,000 new daily infections. Yap notes that the resurgence of COVID-19 cases in China and the new lockdowns that followed have negatively impacted overall economic activities in China and cut the company’s profit growth prospects.

The Citi analyst also feels that the impact of the new COVID-19 cases will delay recovery. The Alibaba stock forecast is also being dampened by new rules that will force Chinese companies to share sensitive data with US regulators. The stock is down 4.19% as of writing.

Alibaba Stock Forecast

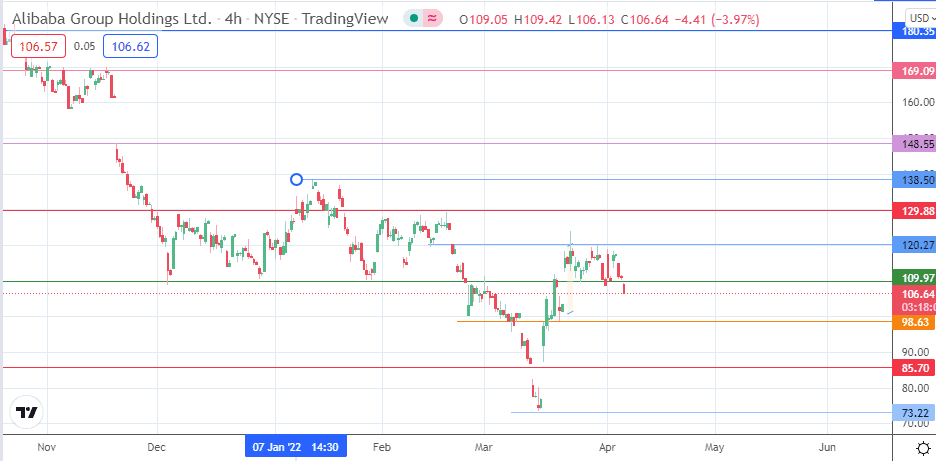

The intraday decline has violated the support at 109.97. A breakdown of this level brings 98.63 (7/21 March lows) into the mix as the immediate target. 85.70 forms another pivot, but there has to be a significant price decline to attain this level.

On the flip side, the bulls need to force a break of the 120.27 price resistance (18 February and 30 March highs) to continue the recovery move. If this is successful, the 129.88 resistance will become the new target. Above this level, 148.55 (18 November 2021 high) forms a new barrier, with a potential pitstop at the 12 January high, which comes in at 138.50.

Alibaba: Daily Chart

Follow Eno on Twitter.