- Summary:

- Brent crude oil price has made a strong pullback in the past few weeks. It is trading at $107 per barrel as China restrictions rise.

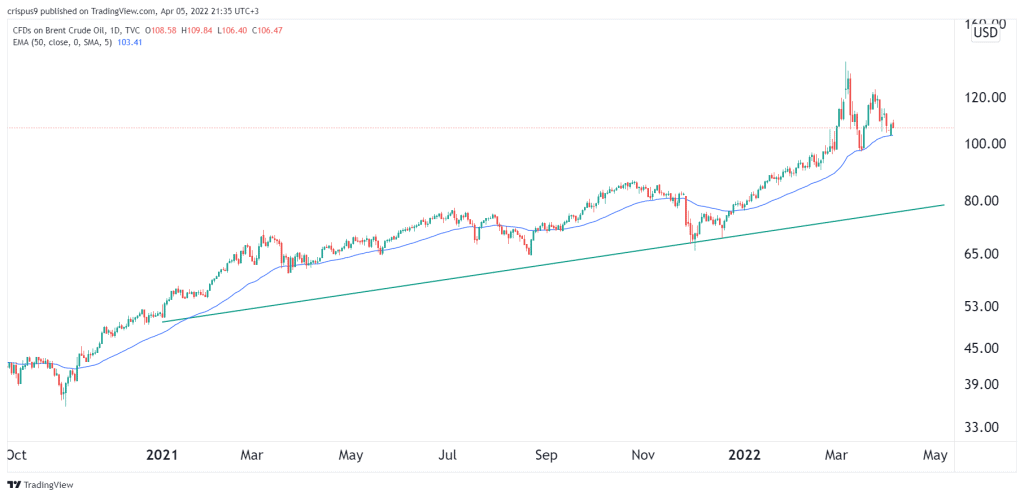

Brent crude oil price has made a strong pullback in the past few weeks. It is trading at $107 per barrel, about 24% below its highest level this year. The West Texas Intermediate (WTI) has also declined by 25% from its YTD high. And some analysts expect that this pullback is a good entry point for long-term investors.

Will oil prices rebound?

Brent crude oil price has cooled down recently as investors react to the decision by the American government to release millions of barrels from the strategic petroleum reserves (SPR) in a bid to lower prices. The price has also cooled because of the new wave of Covid-19 in China. The wave has seen the country announce major lockdowns in a bid to slow the spread. Another reason why prices have retreated is hopes that countries will reach a deal with Iran.

Still, many bullish analysts expect that the price will keep rising in the coming months because of the ongoing supply and demand imbalance. For one, Russia is expected to see a sharp decline in sales this month. As a result, analysts at IEA estimate that the world could lose about 3 million barrels of oil per day this month. Moreover, the situation will worsen if the European Union decides to ban Russian oil. At the same time, Saudi Arabia does not seem concerned about the current prices partly because of the ‘beef’ between Salman and Biden.

In an interview with CNBC, Goldman Sachs’ Jeffrey Currie noted that the current pullback is a good entry point for bulls. He expects crude oil prices to average about $135 per barrel this year. He also cited that there is not enough capital to fund oil projects. Another reason cited is that a recent report by Goldman said that EV adoption in the US will be about 50% by 2050. At the same time, analysts at Morgan Stanley expect that oil will average at $120 this year.

Brent crude oil price forecast

The daily chart shows that the crude oil price have made a strong pullback lately. But despite this trend, the price has remained above the 50-day moving average, signalling that bulls are still in control. It is also above the ascending trendline shown in green. Therefore, I suspect that the bullish trend will continue in the coming weeks as bulls target the next key resistance at $125. A drop below $90 will invalidate the bullish view.