- Summary:

- After the Saudi Aramco attacks, US President Trump has tweeted that the US does not need Middle Eastern oil. USDCAD is trending back downwards.

In the aftermath of the weekend drone attacks on Saudi Aramco’s facilities which cut Saudi oil production in half, US President Donald Trump has tweeted that the US is now in a position where it does not need oil and gas from the Middle East. According to additional tweets, the intervention he is promising to bridge the supply gap is merely to help US allies.

“…we have done so well with energy over the last few years, we are a net energy exporter, & now the number one energy producer in the world…we don’t need Middle Eastern oil and gas, and in fact, have very few tankers there, but will help our allies,” Trump tweeted.

Meanwhile, the USDCAD is starting to trade lower after it had recovered late in the London session. The USDCAD initially opened with a bearish gap to 1.3242, which reflected the response to the weekend attacks. As US President Trump tweeted about the proposed US intervention from its stockpiles to bridge the supply gap, the currency pair recovered to 1.32646.

The pair has started to trade lower after Bloomberg reported that Saudi Aramco officials were less than optimistic about an early recovery of output following the attacks.

Technical Play for USDCAD

Events from Saudi Arabia look set to dominate the price activity on the USDCAD until Wednesday when the Canadian CPI figures as well as the FOMC rate decision and accompanying statement hit the newswires.

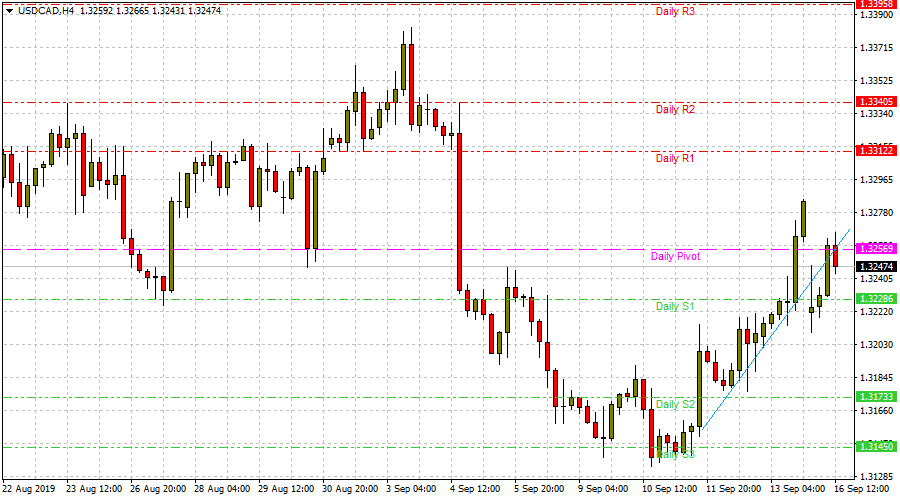

The USDCAD 4-hour chart shows that the bearish gap breached an ascending trendline support that extends from the lows of September 11 till date. The intraday recovery pulled prices up to the broken trendline, but the pullback seems to have been rejected at the trendline.

Further downside on the day could see USDCAD hitting the S1 pivot at 1.32286, with further downside targets seen at 1.31733 and 1.31450.

On the flip side, further recovery which is able to take USDCAD above 1.3256 could open the door for attainment of the R1 resistance at 1.33122 (Aug 29 high) and above that, 1.33405 (September 4 high).